PG Foils Ltd. Detail

PG Foils Limited is in portfolio of Subramanian P. He is one of the top investors in India. The company belongs to Aluminum sector .

As per the Company website it is the third largest aluminium foil rolling capacity in India. It manufactures a range of hard Aluminium Foil as mentioned below

- Bare Aluminium Foil

- Blister Lidding Foil

- Multilayer Laminated Foil

- Pharmaceutical Strip Foil

These products are used in different industries like pharmaceutical, food & beverages, communications, air conditioning and health products. The Company lists some esteemed and big names in its Client list. Some top Clients are Abbot, Cipla, ITC, Bosch and Bayer Crop Sciences.

It exports products to different countries like US, Some countries in Europe and adjoining neighboring countries of India.The head office and plant is situated in Pali Rajasthan. It has branches in major cities of India including Mumbai, Delhi, Bangalore, Kolkata and Jaipur.

Now lets look at performance of this company over the years.As per Dow theory of technical analysis price performance over a period of time reflects Company state.

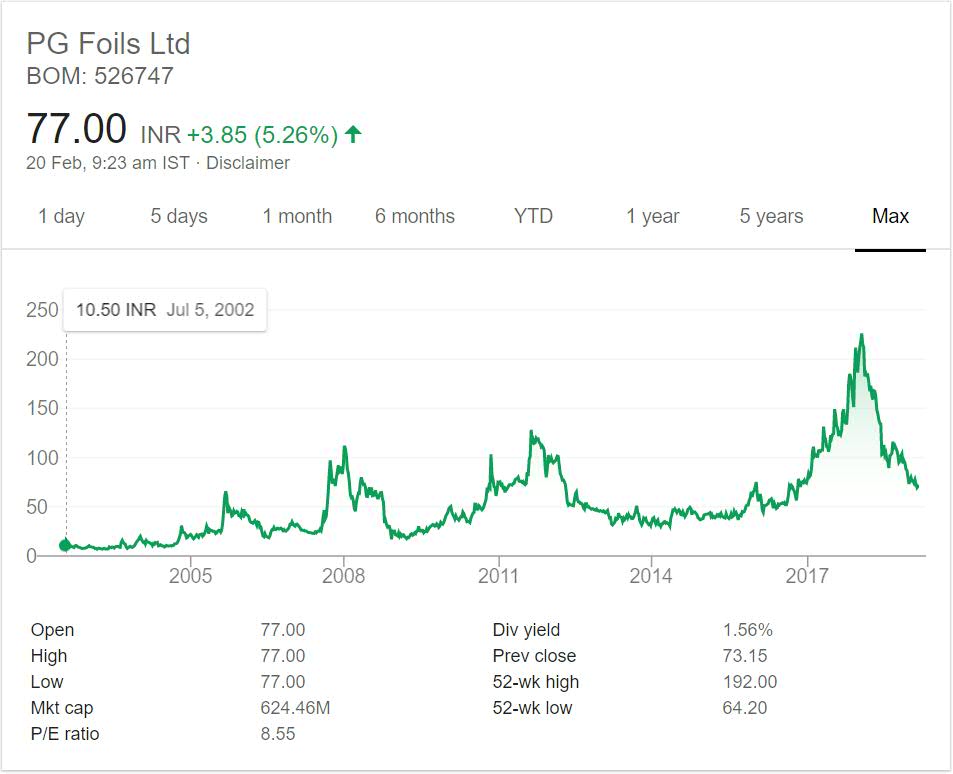

PG Foils Ltd. Stock Performance

The stock has a fluctuating graph. It jumps creating new high and then slows down for extended period of time and then again jumps.The lows are gradually shifting higher as well as highs. This is encouraging for investors.

The Company has given close to 8 times return over the years. Note I am using current price. But if you see the top price then it has given more than 19 times return. But selling at top and buying at bottom is a mirage. The dividend yield at current price point is good (more than 1.5%).

Any price below 50 makes it decent candidate to make a bet. As the lows and highs are shifting higher it can be assumed that Company has improved performance over the years.

PG Foils Ltd. My Opinion

PG Foils Limited is in Aluminum sector. There are not many companies listed in this Category on stock exchanges. The major ones are Hindalco and Nalco. But this one created products from Aluminium for consumption by different industries.

It is is Business to Business Company. The industries it caters are evergreen industries. There was a time Aluminium products were used in house hold utensils as well but they are now replaced slowly with Steel ones.

Like Steel sector I am not too convinced with Aluminum sector. It is more of stagnant and there will not be spike in demand.The demand will be there and the industry will continue to flourish but a slow pace. So companies will grow at lesser pace.

I do not have any Aluminium Company in my portfolio but do have one metal sector company in my Kitty.In case you are interested then you can track the company by adding it to your stock watch list. That way you can keep close eye on the Company.