POCL Enterprises Ltd. Detail

POCL Enterprises Limited is in portfolio of Subramanian P. He is one of the top investors in India. The company belongs to Chemicals sector .

As per the Company website it specializes in manufacturing and trading of various metals, chemicals and their oxides. The different verticals are

- Metallic Oxide division

- Plastic Additive division

- Zinc refining division

- Lead Alloying division

The application of products created by this Company are

- Storage batteries , radiation shielding, solder cable sheathing and alloys and type metals, paints, glass and ceramics

- Varistors, thermal papers,electroplating & dietary supplement in animal feed

- Accelerator, activator & reinforcing agent in rubber

- Ceramic, floor tiles, frits & glazes

- PVC pipes, profiles and cables

- Heat Stabilizer in PVC formulations

The company has manufacturing factories in Puducherry former Pondicherry and Kakkalur in Tamilnadu.

Now lets look at performance of this company over the years.As per Dow theory of technical analysis price performance over a period of time reflects Company state.

POCL Enterprises Ltd. Stock Performance

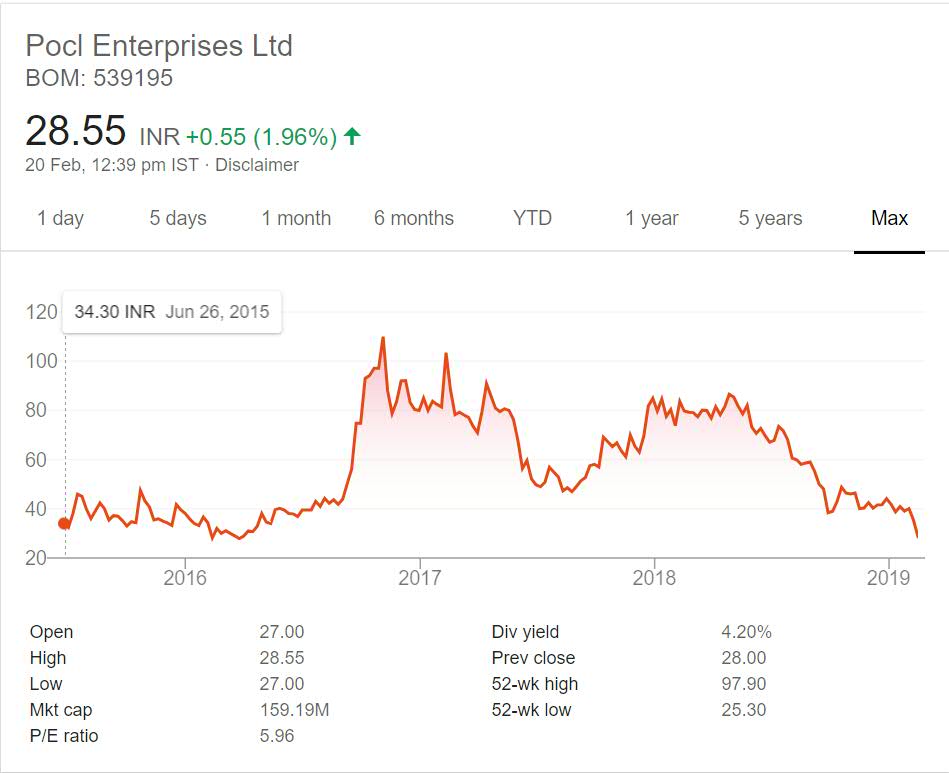

The stock got listed in year 2015. It was good time to get listed due to bull market. The company zoomed from 34 the listing price to over 100 in next one year period. This was golden period for IPO investors as stock gave close to 3 times return in short span of time.

But after that it went downhill and currently trading below the IPO price. The dividend yield at current market price is attractive at 4%. But the decrease in price has made investors suffer.

POCL Enterprises Ltd. My Opinion

POCL Enterprises Limited is manufacturing industry based on Metals. It refines metals like Zinc, Lead. Those end products find use in different industries as mentioned above. So it can be categorized as Business to Business Company.

The fortune of the Company depends on Cost on Input Raw materials and demand of finished products in other industries. The growth in other industry will propel growth in this company assuming it retains and adds customer.

I am not too convinced by product created and their application. They have not mentioned their Clients on the website. As the Company is recently listed I am not too convinced about their performance going forward.

For me it is not worth tracking. I would avoid this Company.In case you are interested in Textiles sector then you can track the company by adding it to your stock watch list. That way you can keep close eye on the Company.