Rainbow Denim Ltd. Detail

Rainbow Denim Limited is in portfolio of Subramanian P. He is one of the top investors in India. The company belongs to Textiles sector. It is part of Rama Group of Companies.

As per the Company website it is part of Indian Denim manufacturing Industry. It creates products in line with fashion requirements of leading Denim garments brands.It has capacity to produce 20 million meters of Denim per year. The Denim produced is delivered as per Client requirements.

It creates Denim in different shades and depths of Blue. The corporate office of the Company is in Mumbai. The factory and registered office is in Mohali Punjab.

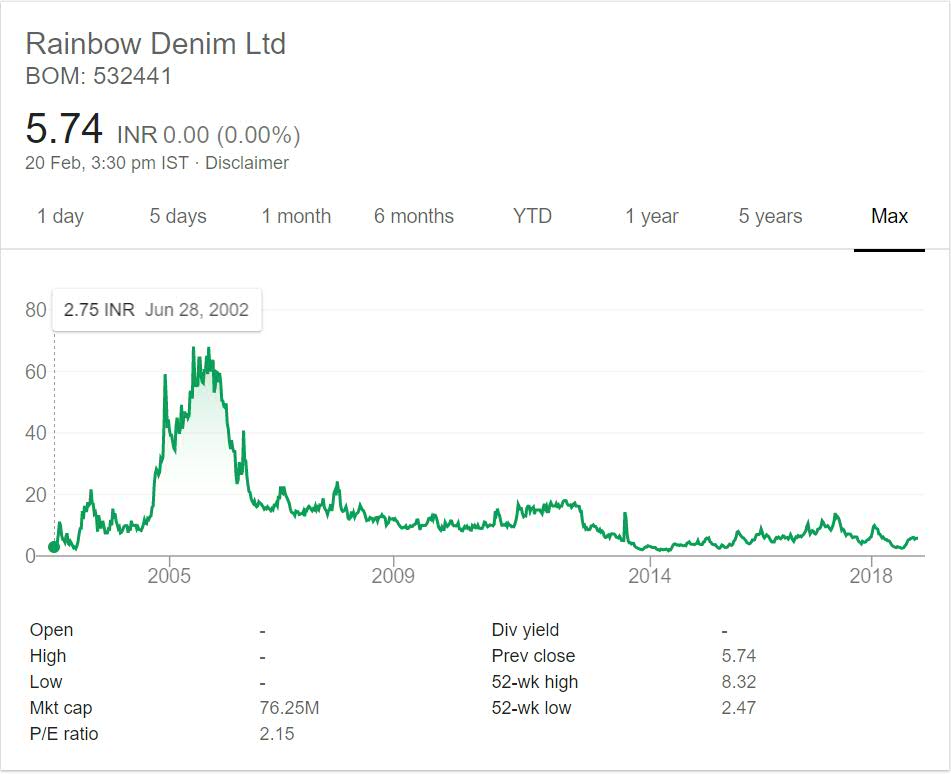

I have shared long term price performance chart of the Company below.As per Dow theory of technical analysis price performance over a period of time reflects Company state.

Rainbow Denim Ltd. Stock Performance

Looking at the chart above you will not get impressed. This is classic example of how so many companies went crazy before 2008 crisis and traded above their intrinsic value due to bull run Indian markets observed during that time frame.

From 2 odd levels to above 60 in three year period is crazy giving 30 times return to investors.But after that it kept on declining slowly and unable to rise past previous highs. As of now it is trading below 10 levels. Investors who invested at the top are now paying price and have suffered huge losses.

Rainbow Denim Ltd. My Opinion

Rainbow Denim Limited is a Textiles sector Company. The ace investor Subramanian P has quite a few textiles sector Company in his portfolio. But this is the only one dealing with Denim. Others mostly deal with Yarns.

Denims became too popular when they arrived on the scene.It became fashion statement. Nowadays also it has maintained the popularity. So the market is there for sure. It has become stagnant and will not grow at the same pace (like it had in past).

The Company produces raw material (Denim cloth) for consumption by Cloth manufacturing Companies. Since there will be demand for these cloths so raw material demand will be present. But as mentioned earlier it is stagnant market. Stock price of a Company rises only if it gives better performance compared to previous results.

Since chances of result improvement is less so stock prices will not perform better with time. Due to these reasons I will not be tracking or investing in this Company. As mentioned in review of Textiles sector Company I do not like the sector as a whole for long term investment.

In case you are interested then you can track the company by adding it to your stock watch list. That way you can keep close eye on the Company.