Rama Phosphates Ltd Detail

Rama Phosphates Limited is in portfolio of Subramanian P. He is one of the top investors in India. The company belongs to Chemicals sector.

As per the Company website it is one of the leading Phosphatic Fertilizer manufacturers, ie. Single Super Phosphate (SSP) fertilizer manufacturing in India.

Below are different product division of the Company

- Fertilizers – Phosphatic fertilizer, Fortified fertilizer, Water soluble fertilizer, NPK mixed fertilizer, Organic Fertilizer

- Chemicals – Sulphuric acid, Oleum, Liner Alkyl Benzene Sulphonic acid,

- Oil and DOC – Soya bean crude oil, Soya De Oiled Cake or DOC, Soya refined edible oil and Lecithin (Food additive)

As mentioned before Fertilizers are main product category of the Company. Along with that it is adding new product lines as mentioned above. The brand under which it operates are Girnaar and Suryaphool (both Fertilizers).

It has manufacturing unit located in Pune, Indore and Udaipur.It has head office in Mumbai. Western India is major consumer of Phosphate based fertilizer. All plants of this Company is situated in proximity of Western India.

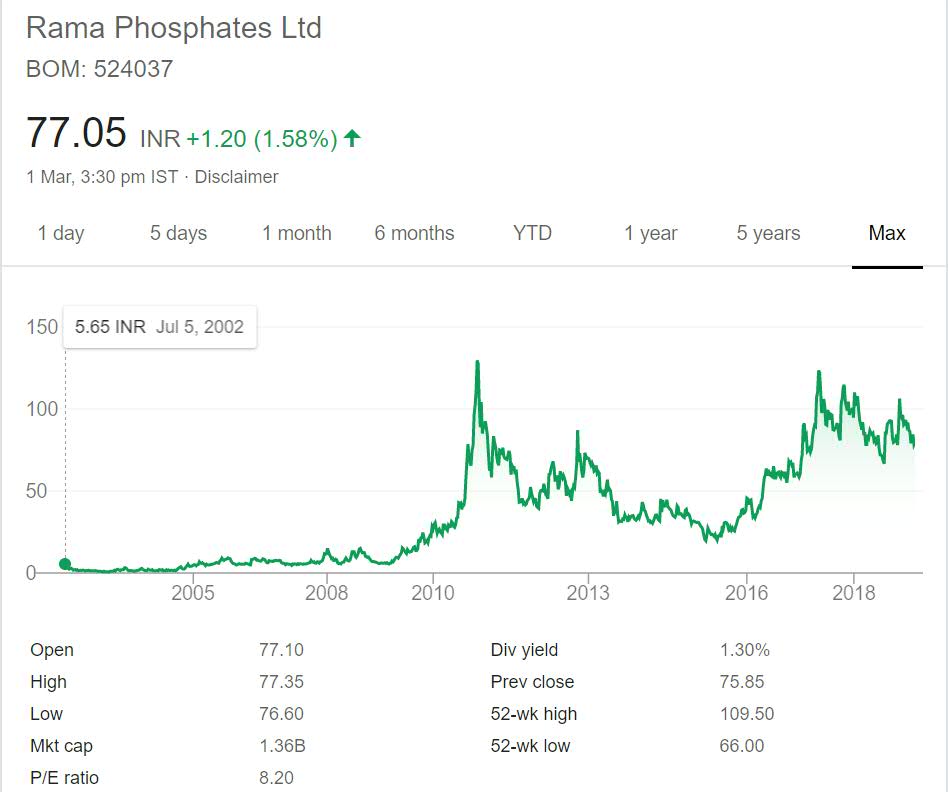

I have shared long term price performance chart of the Company below.As per Dow theory of technical analysis price performance over a period of time reflects Company state.

Rama Phosphates Ltd Stock Performance

The Company has given close to 15 times return in past 16 years. This is better than Fixed deposit and other safer investment options.Though the journey was roller coaster one. It has very nice journey from year 2002 to 2012. It went from 5 mark to above 100 mark giving more than 20 times return to investors.

But from that point to 2015 it struggled every year and prices drop below 50 mark.It has not touched previous best as of now. The dividend yield of the Company is also good. At current level it is more than 1%.

Rama Phosphates Ltd My Opinion

Rama Phosphates limited is Fertilizers sector Company. Fertilizer is growing sector. The only problem it faces is Government policies regarding it and financial condition of farmers across the Country.

With time there is growing need of producing more crops in less area.This demand has forced usage of Hybrid Seeds, Insecticides and Fertilizers. All of them have single motto. The motto is to increase productivity of crops.

Farmers are forced to use these items. Government is also making it easy for them. So there is market for Companies to grab. Sector is good and growth is present. This is a recurring market. Like every year there will be demand for Fertilizers. Also if Companies can tap on Domestic and International market then it will increase their profitability.

Having said that there are many stocks present in these niche. Before making decision about any Stock to track or invest you should compare it with others. Some stocks of this sector have made good growth and gave stellar returns to investors in past. As of now I am not invested in this sector but most likely may select one company from Fertilizer and Crop Protection space.

In case you are interested then you can track the company by adding it to your stock watch list. That way you can keep close eye on the Company.