Kaya Limited Detail

Kaya Limited is in portfolio of Vanaja Sunder Iyer. He is one of the top investors in India. The company belongs to Health Services sector.

As per the Company website it is India’s leading chain of dermatologist-backed clinics committed to delivering flawless skin and healthy hair. The Company operates under two categories.

- Services

- Skin Care

- Kaya Clinics provide solutions for Skin related issues like Aging skins, Dull Skin, Unwanted body hair, Pigmentation and Brightening.

- Hair Care

- Common hair issues are treated like Hair loss in Men, dandruff, Hair Transplant, Hair fall and thinning in Women

- Skin Care

- Products

- Kaya has more than 50+ specialized products for daily Hair care and Skin care for both Men and Women

- It has now launched new products like Eye Care and Bath and Body.

The Company has clinics in 27 cities. It has more than 100 clinics spread around these 27 cities. It also has more than 20 clinics in Middle East. It also has online presence from where you can buy different Kaya products.

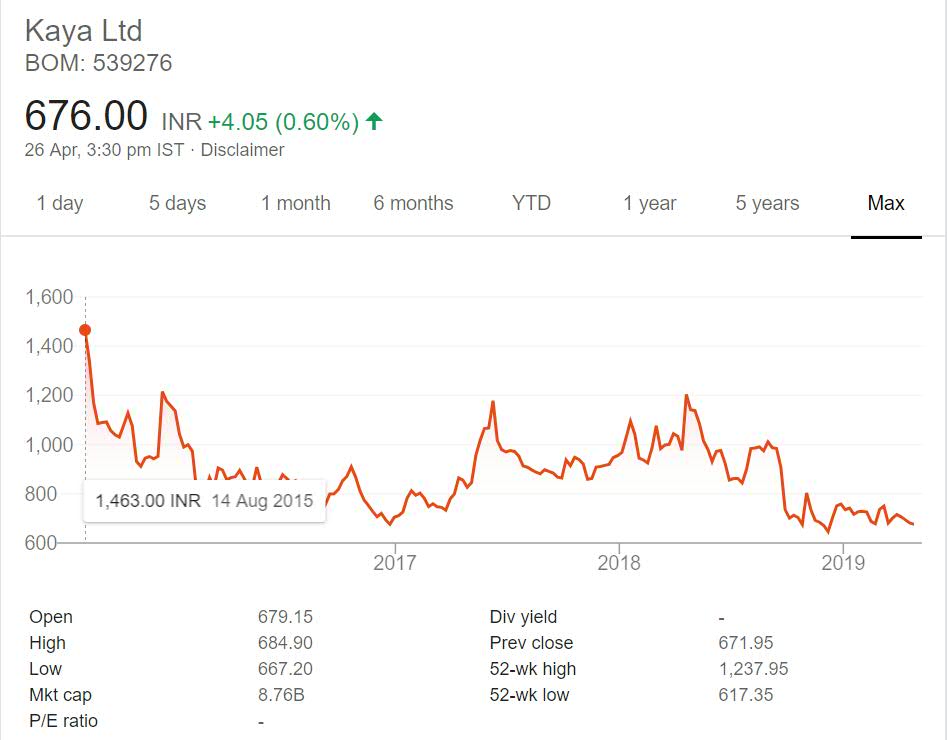

I have shared long term price performance chart of the Company below.As per Dow theory of technical analysis price performance over a period of time reflects Company state.

English Video

Hindi Video

Kaya Limited Stock Performance

It is newly listed stock on stock exchanges. It got listed during the recent bull run phase which started from year 2014. The stock got listed at around 1,450 mark. But soon after listing it started moving downhill and touched price point of 700 that is 50% discount from listing price in year 2016 end.

The stock has not touched listing price heights in this 3 year period. It is now trading near the lows it made in year 2016. So for IPO investors it has not been a good investment as of now. But short term price chart should not be used to pass on judgement for any stock.

Kaya Limited My Opinion

Kaya Limited is a Health Services Company. It deals with products and Services both. As of now it caters mainly Skin and Hair related problems. Though it has some products for Eye Care and generic Bath products.

It is targeting the upper middle class and higher income groups with services and products. Most of the products are highly priced. So it is trying to cash in Status symbol mentality of Upper middle and high income group mass.

The services is also pricey if you consider Dermatologist fees in most part of India. One thing I liked about Company is presence across India with 100 clinics in 27 cities. It also has international presence which would help the Company as well. Currently it targets only middle east and it is yet to be seen if it has plans to target other regions as well.

On management front Kaya has strong proven one. Marico is parent of Kaya and in year 2013 Kaya was de merged from Marico. So it has strong transparent and proven Parent. The Company can if associated brand image with its services and products then it may get re-rated in future.

In case you are interested then you can track the company by adding it to your stock watch list. That way you can keep close eye on the Company.