Raymond Limited Detail

Raymond Limited is in portfolio of Vanaja Sunder Iyer. He is one of the top investors in India. The company belongs to Textiles sector.

As per the Company website it is a diversified group with majority business interests in Textile & Apparel sectors as well as presence across diverse segments such as FMCG, Engineering and Prophylactics in national and international markets.

Below are different business verticals of the Group

- Textiles

- Leading player in Shirting Fabric.Number 1 brand in OTC space.

- It has over 1100 exclusive stores spread across 380+ cities and an expansive network of over 20,000 points-of-sale in India.

- Preferred choice for top design houses across 55 countries

- Only manufacturer of Full canvas premium Jackets in India.

- Introduction of Specialty ring denim in India.

- Apparels Brands

- Brands in this space are Park Avenue, Parx and Colorplus and Raymond Ready to wear

- FMCG

- Present in Male grooming segment under brand Park Avenue

- Home care segment through Premium brand

- Sexual wellness segment through KamaSutra brand

- Engineering

- Largest manufacturer of Steel Files in the world.

- 60% market share in India

- 30% market share in Global markets

- It is also present in Auto Ancillary sector as well. It has annual production capacity 48 lac pieces for Ring Gears, 5 million pieces for Water Pump Bearings and 0.4 million pieces for Flex Plates.

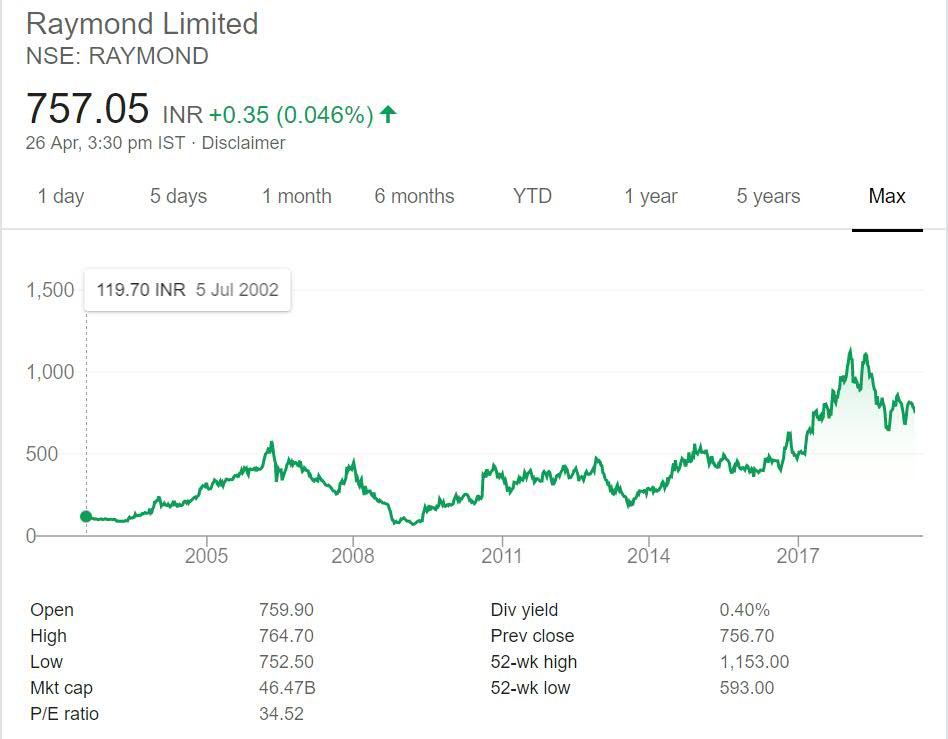

I have shared long term price performance chart of the Company below.As per Dow theory of technical analysis price performance over a period of time reflects Company state.

Raymond Limited Stock Performance

The long term price chart of the Company is mixed to say the least. It has touched 500 mark three times and was successful cracking it the last time only. Before that after touching that price point it would go back to levels of 2002. This is not an encouraging signs for Investors.

It seems Company has made strong base near 500 now as it traded two years in narrow range around 500 mark and then broke it decisively moving towards 1,000 mark and beyond. If you see on absolute basis the stock has given around 6 times return to investors.

Raymond Limited My Opinion

Raymond Limited is a Textiles Company. Frankly this Company should not be clubbed under Textiles sector. It has presence in other sectors as well. Textiles and related segments like Apparels, Denims and Retails store selling textiles products are main business units of the Company.

Raymond is popular brand in Textiles space.I assume most of us are aware of the Brand if not all. It has extensive store presence as well. Most of the small cities like Tier 3 or Tier 4 cities also have Raymond store. It is one of the preferred fabric brands with extensive presence across India.

The FMCG space also has some recognizable brands as well but those are not as dominating presence as Raymond. Park Avenue and Kamasutra does have good presence.

Raymond can be an interesting play in Conglomerate sector. It has presence in most growth sector with Auto Ancillary, Apparels, Grooming and Sexual health and Textiles. All these sectors are evergreen and have will continue to grow at steady rate in coming years.

I have not yet invested in Textile space but am analyzing companies in the space to make an entry if any company satisfies and beats returns I am getting or expecting my current portfolio stocks.

In case you are interested then you can track the company by adding it to your stock watch list. That way you can keep close eye on the Company.