Overview

I have decided to write articles on my trades. This will help me revisit them later and frame my trading decisions in future. This will serve as online log. Website visitors can use it their benefit as well.

Note I am not SEBI registered Analyst and this is not recommendation. This is my online trade log for reference and others can also use it as learning process.

Trade Details

I used couple of tools for this trading.

- Bank Nifty Open Interest Excel Sheet (download link)

- Support and Resistance as shown in below image

Bank Nifty had resistance at 31,600 levels. It was trading near this level on 5th July (The Budget day). It was not able to breach and close above 31,600 despite 70,000 crore INR package for public sector banks.

So I took position 31200 PE at 250 on Friday as the resistance is strong and event is already priced in. Note the position was made in second half of the day not the first half as Budget was underway and it was tough to predict direction of Bank Nifty during Budget.

Instead of closing position on same day I closed it on Monday at 650. Note I was changing it from 650 to 700 but during Noon a sudden fall in Indices closed the position before me changing it.

Profit Details

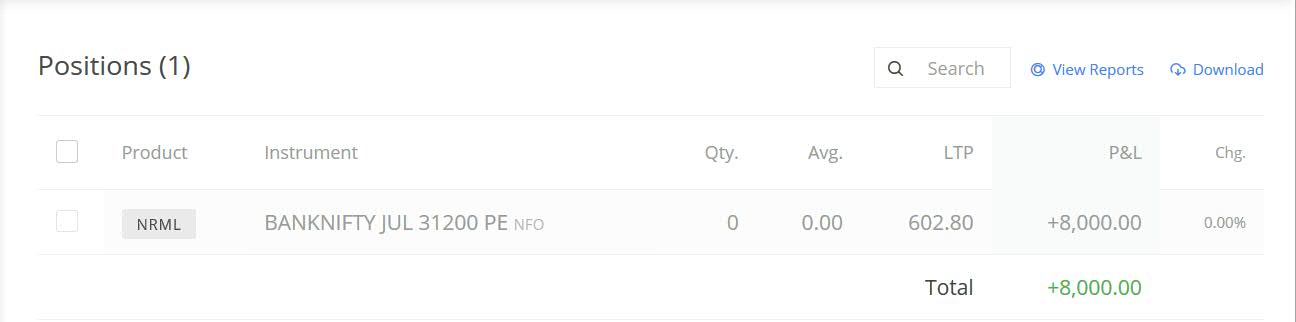

Below is profit details proof for visitors and my own record. Below is my investment and profit details

- Bought Put of 31,200 at 250.

- Total money is (250 *20) = 5,000 as lot size is 20 for bank nifty

- Sold at 31,200 at 650

- Total money made = (650*20) = 13,000

- Total Profit = 13,000 – 5,000 = 8,000

- Profit percent = (8,000 / 5,000 ) * 100 = 160%

Lesson Learnt

Below are lessons learnt from this trade which will help me in future trades

First Lesson

Since Nifty and Bank Nifty both was down more than 1% within few minutes and it was making new lows I should have not placed order. I should have waited and kept the position to sell on Tuesday.

Second Lesson

Bank Nifty bounced from 30,500 levels to more than 100 points two times in trading session. After first time jump a Call position could have been initiated. This would have been a intraday position closing fetching small profit during second jump.