GRP Ltd Detail

GRP Ltd is in portfolio of Anil Kumar Goel. He is one of the top investors in India. The company belongs to Rubber sector.

As per the Company website it is among the most recognised manufacturer of reclaimed rubber from used tyres, upscaled polyamide from nylon waste and engineered products die-cut from end-of- life tyres.

The company operates 4 business verticals (Reclaim Rubber, Industrial Polymers, Custom Die Forms, Retreading) with 7 manufacturing units across India with an installed capacity to handle 75,000 MT per annum to service the needs of the global polymer industry.

- Reclaim Rubber

- Natural rubber reclaim

- Synthetic rubber reclaim

- Polycoat

- These products are used in Tyre applications like Inner liner, Inner tubes, Tyre threads and rethreads

- It is also used in Non Tyre applications like Conveyor belts, Footwear, Roofing and Adhesives.

- Polymer Composite

- Used in logistics, Oil and Gas like sectors

- Custom Die forms

- Mats like Link Mats, Door Mats, Dock bumpers

- Industrial Polymers

- Reprocessed Nylon 6 – Glass filled

- Reprocessed Nylon 6 – Unfilled

- Used in sectors like Automotive and Electricals and Electronics

- JV with Marangoni

- Splice less thread

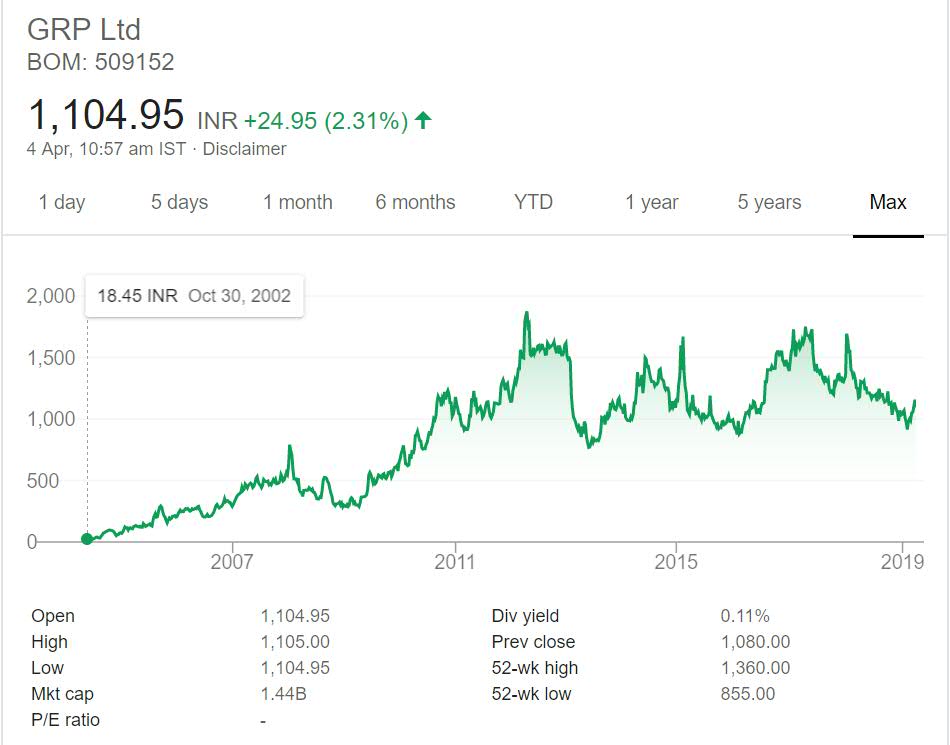

I have shared long term price performance chart of the Company below.As per Dow theory of technical analysis price performance over a period of time reflects Company state.

English Video

Hindi Video

GRP Ltd Stock Performance

On an absolute basis GRP limited is an multi bagger giving more than 50 times return in last 16 years or so. The stock have majority of returns before year 2011. It was quoting at 1,000 INR at that time itself.

Last few years stock has been in consolidation mode with upper bound being 1,500 and lower being close to 1,000. For next level growth it needs to expand the footprint and break above the consolidation range. You can use this range to make timely profit in the counter but for long term investors the range movement is frustrating.

GRP Ltd My Opinion

GRP Ltd is a Rubber Company. It is not a general rubber Company. It deals with reuse and recycle of used Rubber. Note that Rubber is also a natural resource. The natural rubber prices often dictate Tyre prices as well.

The Company reclaims and reuse the rubber used in Tyres. This completes a cycle in itself. With growing focus on recycle and preservation of natural resources Company area of operation will get benefited.

It has segregated itself into multiple verticals. Some of the products created by these verticals find usage in different industries. This diversification will help Company generate alternative revenue source which is very much required for it.

Rubber is an interesting sector. There will be demand of this sector. Tyres still form major part of transportation. Also other rubber products are still in wide use. As of now I have not invested in this sector but am exploring the sector for investment.

In case you are interested then you can track the company by adding it to your stock watch list. That way you can keep close eye on the Company.