Ador Fontech Ltd Detail

Ador Fontech Ltd is in portfolio of Anil Kumar Goel. He is one of the top investors in India. The company belongs to Welding sector.

As per the Company website it is is a front-runner organization that operates on the philosophy of ‘partnering’ with its clients in recommending and implementing value-added reclamation, fusion, surfacing, spraying and environmental solutions.

Below are business verticals of the Company. This will help you understand business operations carried out by this Company. The business operations can be divided into below operational categories.

- Manufacturing

- Low heat input welding alloys, FCW wires, TIG/MIG/SAW filler rods, Ceramic lined pipes, Wear plates and Welding Equipments

- Repair

- Welding and metal spraying processes are used to reclaim and rebuild vital machinery parts of Core Industries like Power, Steel and Cement etc

- Refurbishment

- Life enhancement services. This is customer specific life reclamation service.The Life enhancement services are offered to industries like Petroleum Refinery, Cement and Mining.

The Company has Corporate office in Bengaluru. Both of its manufacturing plants are situated in Bengaluru itself. The reclamation center is situated in Nagpur.

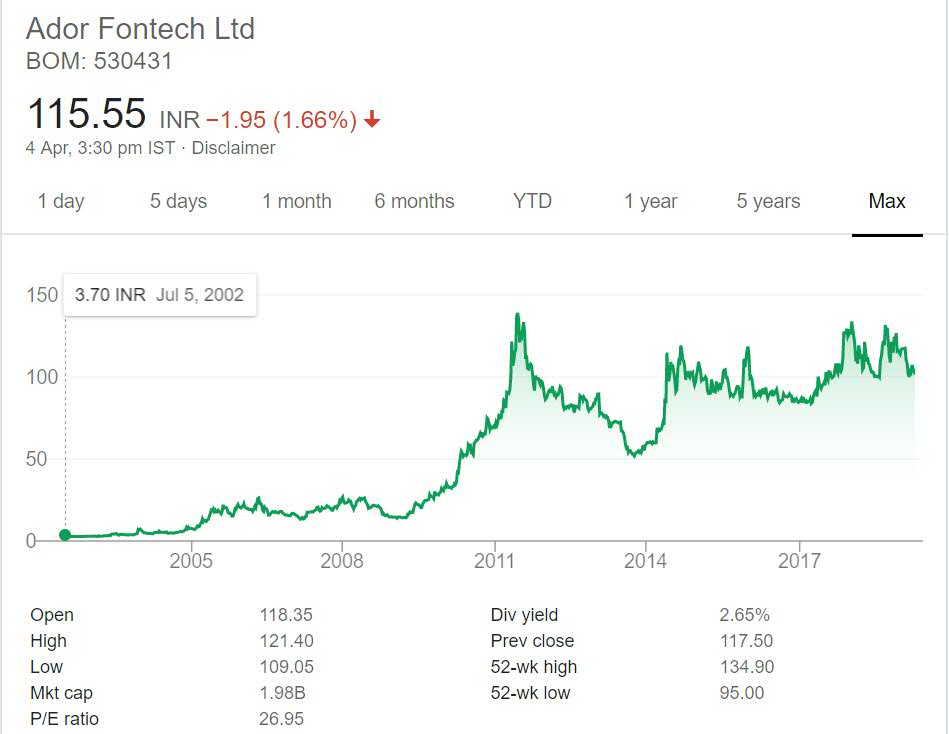

I have shared long term price performance chart of the Company below.As per Dow theory of technical analysis price performance over a period of time reflects Company state.

English Video

Hindi Video

Ador Fontech Ltd Stock Performance

This stock is classic example of returns and then frustration. If you look at long term horizon then it has given more than 25 times return to investors. It is also one of the most consistent good dividend payer Company for long. So investors have made money with price increase as well as dividend pay.

But after year 2011 despite the recent bull run and then correction phase the stock remained stagnant. It has not given any positive movement in last few years. The stock is range bound with 150 as upper limit of its movement and less than 100 gives you buying opportunity.

Ador Fontech Ltd My Opinion

Ador Fontech Ltd is a Welding Company. It is part of Ador Group of Companies. This group has good presence in Welding business. Welding in a niche segment with very less number of Companies listed in this space.

You can view this Company as Services Company. The core industries like Steel, Cement , Mining and Petroleum Refinery have complex machines. These machines are costly and wear down with time. The Company provides maintenance services to these Core Industries thus helping them prolong life of these machines.

Most of its product and business services cater need of reclamation and prolong the life of machinery. The growth in these Core sectors will help Companies like Ador Fontech. As of this writing Company does not have presence in other Countries. It caters only internal Customers.

As of you can see Company is stagnant as of now. The performance is steady as this is maintenance type of activity. It needs to explore overseas market as well if it wants to grow and provide good return to investors.

In case you are interested then you can track the company by adding it to your stock watch list. That way you can keep close eye on the Company.