Shivam Autotech Ltd Detail

Shivam Autotech Ltd is in portfolio of Anil Kumar Goel. He is one of the top investors in India. The company belongs to Auto Ancillary sector.

As per the Company website it is one of the largest manufacturers of transmission gears and shafts in India. Below are list of products from the Company

- Transmission Gears and Shafts

- Starter Motor Components

- Refurbishment

- Starter Motor Components

- Alternator Components

- Precision Engineering Components

- EPS Components

The Client list of Company includes names like Bosch, Denso India, India Nippon Electricals, Maruti Suzui, Lukas TVS and Hero MotoCorp limited. The Company is head Quartered in New Delhi.

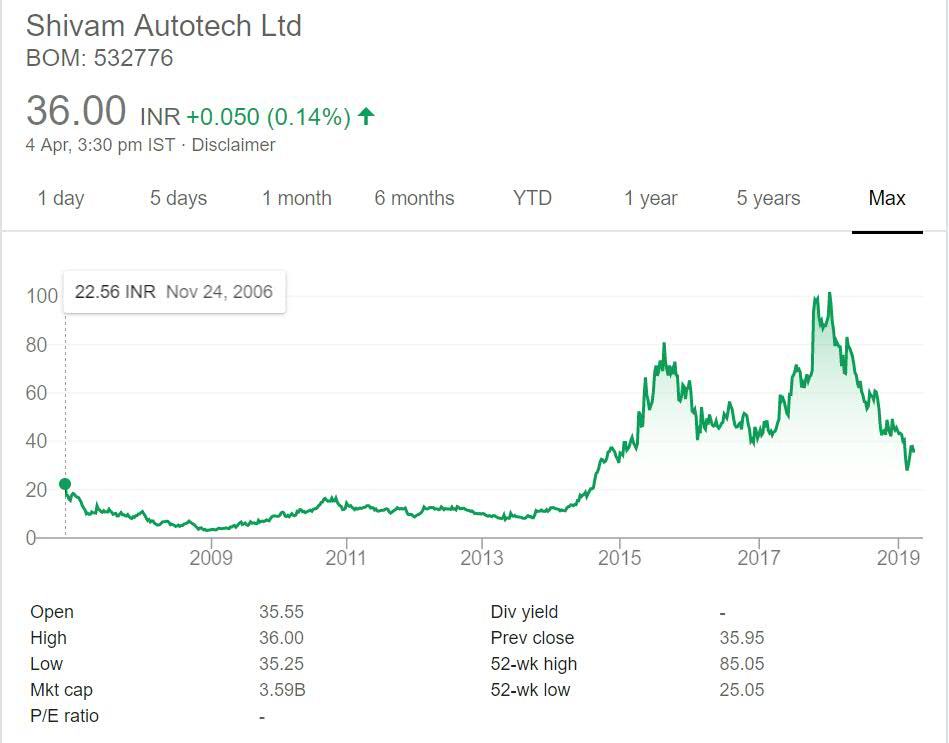

I have shared long term price performance chart of the Company below.As per Dow theory of technical analysis price performance over a period of time reflects Company state.

English Video

Hindi Video

Shivam Autotech Ltd Stock Performance

The stock has not performed well on stock exchanges. It has given positive returns but the returns are well below the top players in this niche. In last one decade the stock has given two times return at max considering the 2006 price with current price.

Till year 2013 the Company kept on trading below the 20 mark. It had flat trajectory signifying on incremental performance growth over the years. It is only in recent years it have risen to give some positive returns for investors. The IPO investors have worst experience getting negative slow movement for first few years.

Shivam Autotech Ltd My Opinion

Shivam Autotech Ltd is a Auto Ancillary Company. It has niche product of Transmission Gears and Shafts. Note Auto Ancillary is space dominated by Multinational players. It is still a new theme in Indian stock market. Indian companies are slowly getting into manufacturing part facing tough competition with Global peers.

Bharat Gears is yet another major player in India dealing with Gear space. The space is getting competitive and Companies with cost advantage and quality advantage will have benefit in long run.

If you have to invest in Auto Ancillary companies look for Company producing unique product and backed by excellent parentage. Companies who can consume the products internally. Companies who have technical collaboration with established players. Those will have advantage over other smaller players.

I have already invested in Auto Ancillary sector and will not increase my exposure in the segment as of now.

In case you are interested then you can track the company by adding it to your stock watch list. That way you can keep close eye on the Company.