Mold Tek packaging Detail

Mold Tek packaging is in portfolio of Ashish Kacholia. He is one of the top investors in India. The company belongs to Packaging sector.

As per the Company website it is the leader in rigid plastic packaging in India. It is involved in the manufacturing of injection molded containers for lubes, paints, food and other products.

The Company products can be divided into four categories as mentioned below

- Lube Packaging

- Manufacturing of injection-molded containers for lubes

- Paint Packaging

- India’s leading packaging specialist for paints.

- Food Packaging

- Manufacturing food packaging for automatic filling.

- Packaging for products like Ice Cream, Edible Oil, Drink powders and Dairy products

- Bulk Packaging

- Bulk containers for bulk drugs, chemicals and food

There are some leading names in Client list of the Company. In paints sector Asian Paints and Akzo Noble are customers of it. In lubricants Shell, Veedol and Gulf Oil are the Customers. In FMCG sector it caters to ITC, Unilever and Cadbury. These are the three major sectors this Company caters to.

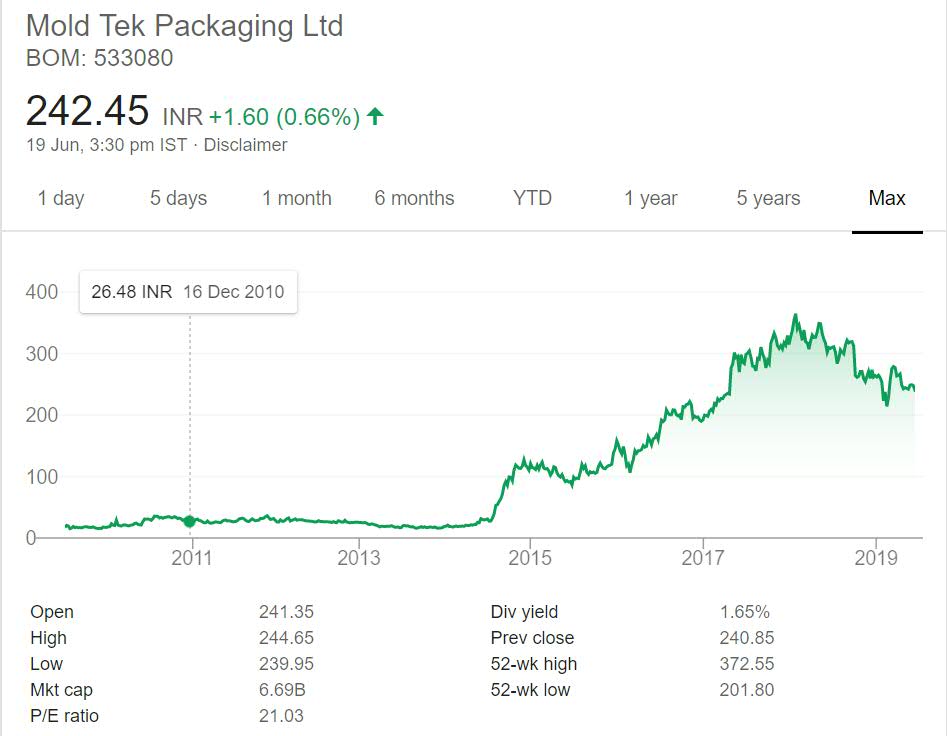

I have shared long term price performance chart of the Company below.As per Dow theory of technical analysis price performance over a period of time reflects Company state.

English Video

Hindi Video

Mold Tek packaging Stock Performance

The stock was in consolidation mode till year 2015. It was neither moving up or down during this time period. The prices were slow to rise and fall and investors have virtually no return from the stock.

After long consolidation stock made positive move giving close to fifteen times return in short span of time. It moved from 20 odd levels to more than 300 INR price point. One more positive point about the stock is high dividend yield. At current market price it is giving more than 1.5% which is excellent by any standard.

Mold Tek packaging My Opinion

Mold Tek packaging is a Packaging Company. It is business to business Company. It caters to different sectors like Paints, Lubricants and FMCG. All the products are aimed to these three sectors with Paints and Lubricants being the major one.

For a business to business Company target industry should grow. For example if there is growth in Paints sector then there will be more production. So Company will get more orders for packaging. All the sectors catered by this Company are growth sectors be it Paints or Lubricants or FMCG.

The only question is that Company should retain the Customers from these sectors.As of now it has some top names from these industries in its client list. If Company is able to maintain the Clients then it will grow else it will have problems in growth.

Packaging as a sector will grow as there will be increasing demand of products to be packaged and sold. Gone are the days of unpackaged non branded items. Now everything is branded and people are moving to packaged items be it food items or grocery.

This is the reason many ace investors have invested in this sector. I have not invested in this sector but am evaluating companies in this sector.

In case you are interested then you can track the company by adding it to your stock watch list. That way you can keep close eye on the Company.