English Video

Hindi Video

Business Detail

RMG Alloy Steel is in portfolio of Dilip Kumar Lakhi. He is one of the top investors in India. The company belongs to Steel sector.

As per the Company website it is an alloy and steel plant. The steel plant is located in Bharuch in Gujarat. The plant has 150,000 MT annual production. It produces various grades of Carbon, Alloy and Special steels.

It also has high precision rolling mill with annual capacity of 125,000 MT annually.It is one of the very few steel plants in India to be housing an NABL accredited testing facility. The Client list of Company has some marquee names like Rolex Rings, Ashok Leyland and Indian Railways etc.

Welspun Group is major strategic investor in this Company.

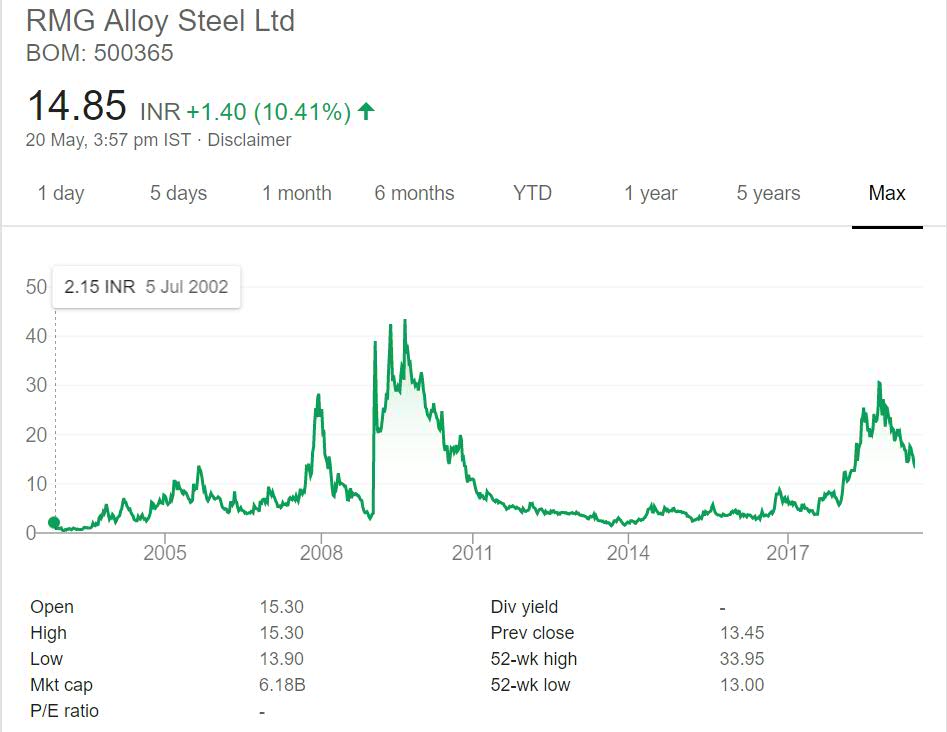

I have shared long term price performance chart of the Company below.As per Dow theory of technical analysis price performance over a period of time reflects Company state.

RMG Alloy Steel Stock Performance

The long term price performance chart of the Stock looks distorted by long steep positive movements and sharp falls and prolonged inaction areas. This was the fate of stock after 2009 jump and before 2008 jump. Both the times the stock zoomed past very swiftly and then cooled off quickly as well.

If we leave these periods of erratic movement then majority of time it has traded below 10 INR mark. It had good sharp movement in year 2018 as well followed by correction. So traders or investors should wait for the consolidation period before jumping on the stock.

RMG Alloy Steel My Opinion

RMG Alloy Steel is a Steel Company. Steel is a cyclic sector and most stocks in this sector will have fluctuating graph with periods of positive movement followed by negative ones.

The sector is capital intensive so you should always pick companies which have good proven management. Debt is one factor you should always track for Steel Companies. Steel as a sector is evergreen. There will be demand of Steel products in India as well as World. The usage of Steel will be present in future as well.

This is competitive sector as well. There are big players as well as small players trying to get a pie share of market and grow. This makes selecting companies in this niche tough as well.

As of now I am not invested in this sector nor I am considering to invest in it as well. I would recommend exploring other Companies in this niche if you are interested in the sector before making any decision.

In case you are interested then you can track the company by adding it to your stock watch list. That way you can keep close eye on the Company.