English Video

Hindi Video

Business Detail

TRF Limited is in portfolio of Dilip Kumar Lakhi. He is one of the top investors in India. The company belongs to Engineering sector.

As per the Company website it executed various electro mechanical jobs for bulk material handling equipment. The Company is part of TATA Group of Companies. The Company was promoted by TATA Steel, ACC Cement, Hewitt Robins US and General Electric Company UK.

The manufacturing facility of Company is located in Jamshedpur. It also perform design and engineering tasks here as well. The business operations of Company can be divided into three heads

- Electro Mechanical Jobs

- Industrial Structure and Fabrication

- Life cycle services and allied services

Hewitt Robins International Limited UK is one of the subsidiary.It operates in bulk material business in United Kingdom, Europe and Middle East. The clientele of the Company includes names like JSPL, NMDC, Tata Steel, NTPC and Lanco Infratech.

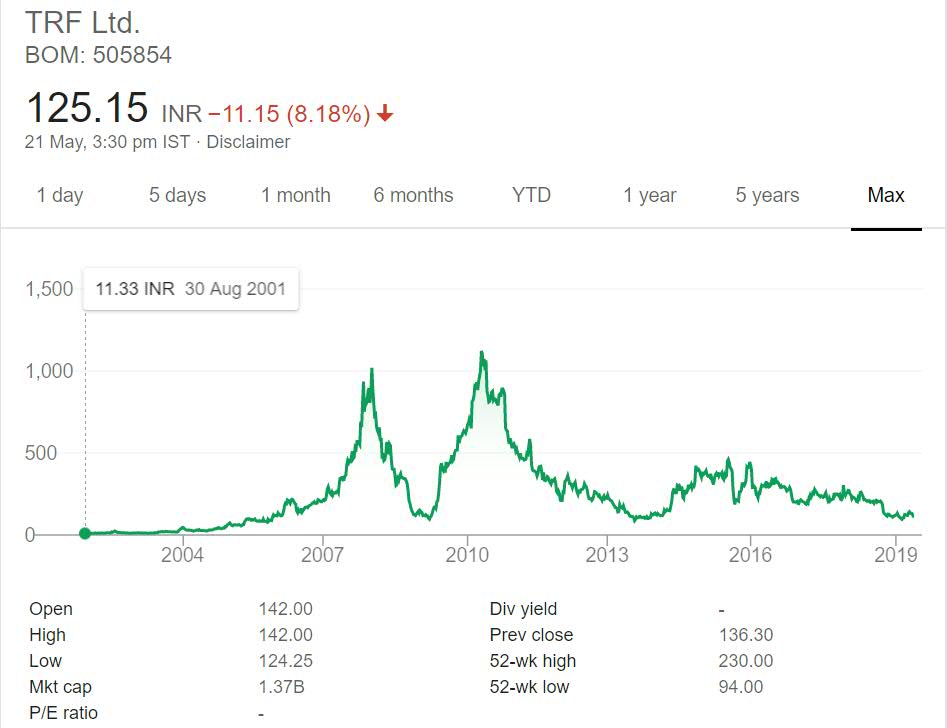

I have shared long term price performance chart of the Company below.As per Dow theory of technical analysis price performance over a period of time reflects Company state.

TRF Limited Stock Performance

This stock is classic example of Why buy price or timing the entry in any stock is important for investors. Also it tells investors why one should time the exit as well. So entry and exit both should be worked upon to make profit in market.

This stock has given excellent return to investors if the entry and exit points are correct if not they have lost huge wealth in this counter. If one has entered it between 2001 to 2007 then they have made exceptional amount of money. Any one entering during the global crisis made huge money in one year period. But after that Company has struggled and slowly went downhill.

TRF Limited My Opinion

TRF Limited is a Engineering Company. It is in business of equipment manufacturing. The Company has products mainly for different industries like Steel and Power.TATA Steel another TATA Group of Company is one major client along with public sector companies of India like NTPC and NMDC.

There is no question about Management pedigree and Corporate Governance as Company belongs to one of the best business houses in India. I like Companies were we do not have to worry about these two factors. Any Company you are investing you should make sure these two factors are taken care of during analysis phase.

As for the sector I am not invested in Engineering sector as of now. I am planning to do so. Even if it is Business to Business sector it is required for Economic growth of any Country. The machinery it provides to different critical industries will remain running in near future.

The price performance in last seven years are bit off a question mark. I will add the Company to my track list as it will give more idea about Company progress over the years.

In case you are interested then you can track the company by adding it to your stock watch list. That way you can keep close eye on the Company.