Kama Holdings Ltd Detail

Kama Holdings Ltd is in portfolio of Ricky Kirpalani and Haresh Keswani .He is one of the top investors in India. The company belongs to Financial Investments sector.

As per the Company website it is controlled by the Arun Bharat Ram family, Kama Holdings also has business interests in education , real estate and investment through three wholly owned subsidiaries

- Shri Educare Limited

- Kama Reality (Delhi) Limited

- SRF transnational holding limited

Shri Educare Limited (SEL) is an entity providing quality education, essentially by way of setting up schools (from nursery to class 12) and pre-schools, and undertaking education consultancy, in India and abroad. These schools are modeled on the pattern of The Shri Ram Schools, an initiative of SRF Foundation, the social wing of SRF Limited.

KAMA Realty (Delhi) Limited, inter-alia owns commercial properties in Gurgaon and Mumbai.

SRF Transnational Holdings Limited is a registered NBFC engaged in the business of investment in securities of other companies.

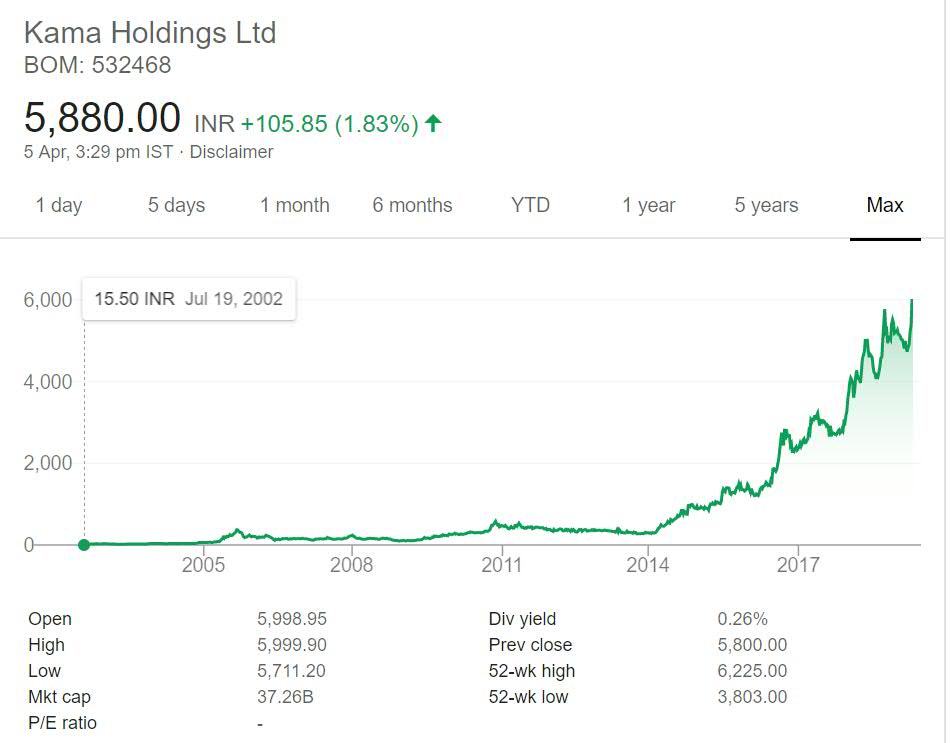

I have shared long term price performance chart of the Company below.As per Dow theory of technical analysis price performance over a period of time reflects Company state.

Kama Holdings Ltd Stock Performance

This type of long term stock performance graph is happy scenery for any Investors. The stock has made good fortune for investors over the years. If you look If you look at absolute returns then stock has given close to 400 times return in past 16 year period which is incredible by any extend.

The dividend yield at current market price is .26% which if coupled with price gain makes it awesome. The investor in year 2002 is getting back more than he invested from dividend itself. This is beauty of price gain and consistent dividend paying Company. Till year 2014 it gave around 20 times return and from that point in last 4 years it gave another 20 times return making an exceptional overall return of 400 times.

Kama Holdings Ltd My Opinion

Kama Holdings Ltd is a Financial Investment Company.SRF is the main company from the stable. SRF has turn over of 5,600 crores and has more than 135 process patents. The growth of Company will help the Kama holdings as well.

Apart from that Kama Holdings has presence in Education field as well. You can view it as Holding Company of three separate business entities with SRF being the most dominant one. You can compare Kama holding with other holding Companies like Tata investment (a Tata Group Company) and Bajaj Holdings (a Bajaj Group Company).

For analysis of Holding Companies I recommend you to look all the Companies under umbrella of it. The performance of Holding Company depends on performance of underlying Companies. So if underlying companies are good then performance of holding Company will be good.

As of now I do not have any holding Company in my portfolio. But I am exploring these type of Companies and may invest some part in one of it. It is good to have small allocation to holding Company in portfolio. Some holding companies have good dividend and are fail safe investment.

In case you are interested then you can track the company by adding it to your stock watch list. That way you can keep close eye on the Company.