Arman Financial Services Detail

Arman Financial Services is in portfolio of Mukul Agarwal. He is one of the top investors in India. The company belongs to Finance sector.

As per the Company website it is registered category A non banking financial company. The Company has two major business operations

- MicroFinance

- Group based Micro Finance

- Offered by wholly owned subsidiary Namra finance limited

- Namra Finance is a RBI Registered NBFC-Microfinance Institution (MFI)

- Asset Finance Company

- Two wheeler finance

- Three wheeler finance

The Company was incorporated in year 1992 and made initial public offering (IPO) in year 1995.

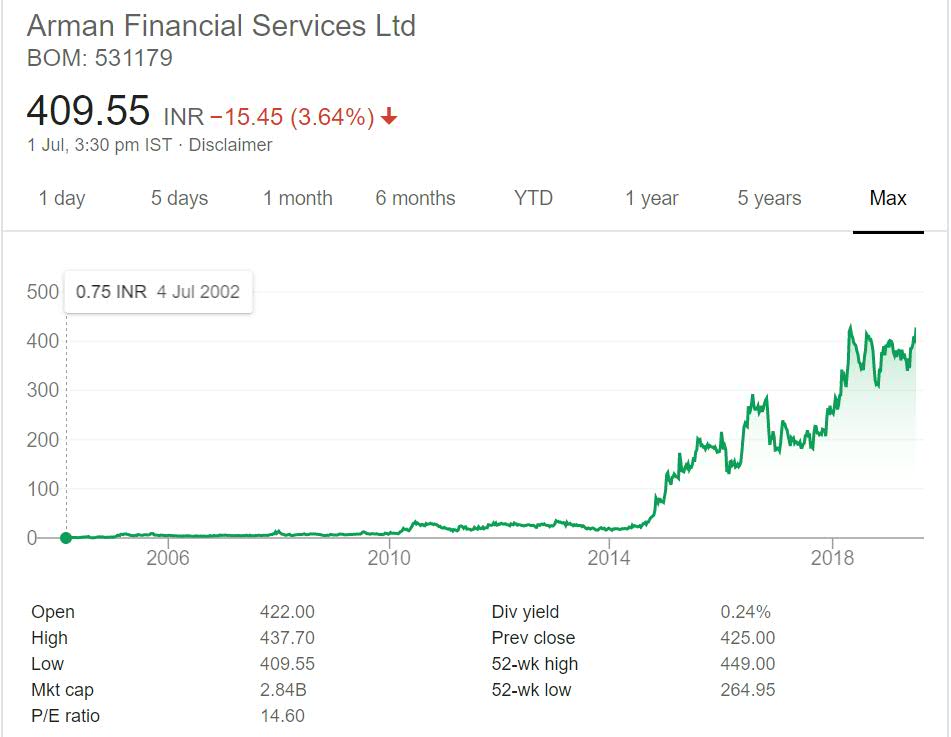

I have shared long term price performance chart of the Company below.As per Dow theory of technical analysis price performance over a period of time reflects Company state.

Arman Financial Services Stock Performance

Investors have made huge money in this Counter. If anyone has invested around 1,000 in year 2002 then the person is sitting at 4 lakh today excluding the income from dividend. This makes it a excellent return counter on the exchanges as of now.

Note majority of returns was only after year 2014. It is worth mentioning that NBFC stocks were most impacted during this bull run and majority of them gave excellent returns before the liquidity crunch later in the run. It was not impacted by the crunch and performed fine in recent market correction as well.

Arman Financial Services My Opinion

Arman Financial Services is a Finance Company. The Company gives Group Microfinance loans. Group Microfinance means you give small sum of money as loan to individual. Individual should be part of a Group and if the individual defaults others will have to pay the Loan. This minimizes chances of default as you are distributing the risk from individual to whole group.

On ground I have seen this Microfinance concept is gaining ground. Many people are making use of this facility to take small loans for their work or any other urgent need. Microfinance target consumer groups is low income group individuals. This is gaining increasing popularity in India and have good scope in future.

Other segment is Two wheeler and Three wheeler loan segment. This is also small money loan segment and chances of default is less compared to home loan or other big loans like business loans. So it can be considered bit safe and less chances of NPA issue haunting the Company.

I prefer to invest in Good reputed management backed Financial Institutes. It is very difficult to read and interpret financial company statements and annual results (example DHFL in which Rakesh Jhunjhunwala invested). I have invested in this sector and will increase exposure in that Company. I will not be tracking this Company as of now.

In case you are interested then you can track the company by adding it to your stock watch list. That way you can keep close eye on the Company.