Dynamatic Technologies Ltd Detail

Dynamatic Technologies Ltd is in portfolio of Mukul Agarwal. He is one of the top investors in India. The company belongs to Engineering sector.

As per the Company website it designs and builds highly engineered products for Automotive, Aeronautic, Hydraulic and Security applications.It is vertically integrated, with its own alloy-making and casting capabilities as well as its own captive green energy sources.

The business operations of the Company are divided into below divisions

- Hydraulics

- Is one of the world’s largest Hydraulic Gear Pumps makers

- Aerospace and Homeland security

- Development of exacting Airframe Structures and Precision Aerospace Components.

- Offers cutting-edge security solutions to enhance the Nation’s capabilities in countering modern day security threats

- Automotive and Metallurgy

- Produces high quality Ferrous and Non-Ferrous Automotive Components for Highway, Off-Highway and Technology oriented applications for leading Global Automotive OEMs

- Produce high quality Non-Ferrous Alloy and Castings for Industrial, Automotive and Aerospace Applications

- Engineering and Design

- Improvement of existing products

- Design and prototyping of new products

The facilities are located in India (Bangalore, Chennai, Coimbatore, Nasik), United Kingdom (Swindon, Bristol) and Germany (Schwarzenberg).

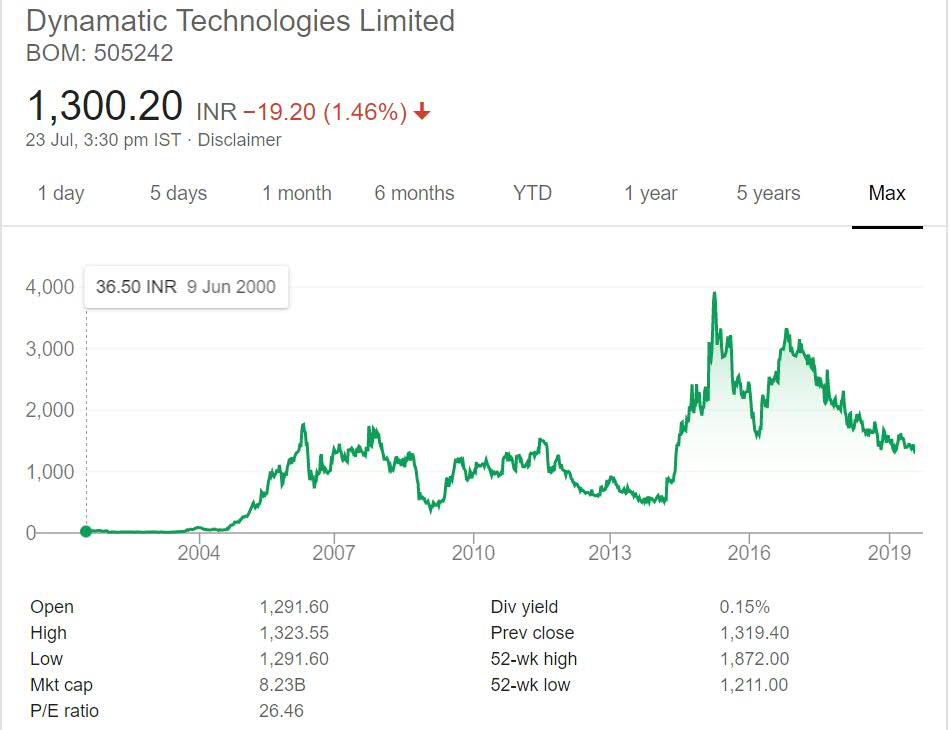

I have shared long term price performance chart of the Company below.As per Dow theory of technical analysis price performance over a period of time reflects Company state.

Dynamatic Technologies Ltd Stock Performance

The stock gave stellar returns of close to 50 times between year 2000 and 2006.Between this time period it has secular growth but afterwards it has not performed well. The Stock had rough phase between year 2012 to 2014. The bull run of 2014 helped it give approx 6 times return in one year duration.

It is unable to sustain at those levels and have corrected near 1000 mark. Last couple of years were not good for stock as it has corrected from close to 4,000 levels to near 1,000 levels giving most of the returns between year 2014 and 2016.

It is also regular dividend payer but the yield is low at around .15%.

Dynamatic Technologies Ltd My Opinion

Dynamatic Technologies Ltd is a Engineering Company. It serves different industries with its products. It is one of the largest manufacturers of Hydraulic pumps which gives it a distinguished position.

The Company aims to become top player in this segment. Hydraulic pumps find usage in Agricultural Equipment, Construction Equipment, Material Handling Equipment, Mining and Drilling Equipment and in Marine applications. So it has wide range of applications and the sectors are not inter dependent.

Security segment caters security needs of Aerospace which is vital.It is involved in India’s target less pilot aircraft. It is also certified supplier to Boeing and Airbus. This establishes it as premier player in this segment.

The Automobile and Metallurgy sector as the name suggests caters needs of Automotive Industry and Aerospace industry. It provides Complex Metallurgical Products for Automotive Engines and Turbochargers.

The Company looks a promising one as per the above details. I will be tracking this Company closely to gain more insight of it. As of now I have not invested into Engineering sector.

In case you are interested then you can track the company by adding it to your stock watch list. That way you can keep close eye on the Company.