GM Breweries Detail

GM Breweries is in portfolio of Mukul Agarwal. He is one of the top investors in India. The company belongs to Distillery and Beverage sector.

As per the Company website it is engaged in the activities of manufacturing and marketing of Alcoholic Beverages such as Country Liquor (CL) and Indian made Foreign Liquor (IMFL). It is the largest manufacturer of country liquor in the state of Maharashtra with a sizeable market share.

Below are brands from this Company

- Santra

- It is the leading and most prestigious brand from the Company

- It is top product in Country Liquor Industry for the past 12 years, in the State of Maharashtra.

- Doctor

- 25 year old brand.

- Limbu Punch

- Dilbahar Sounf

- Other major brands from the Company

Company head Office is located in Mumbai and Factory is located in Thane. The bottling facility at factory has capacity to produce about 50,000 cases a day.

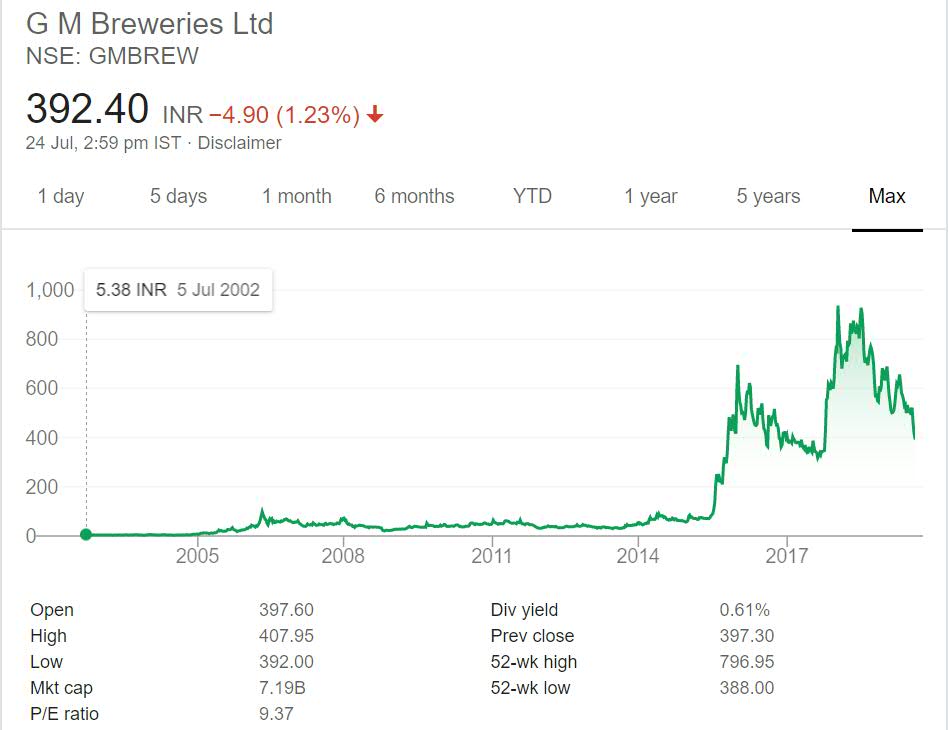

I have shared long term price performance chart of the Company below.As per Dow theory of technical analysis price performance over a period of time reflects Company state.

GM Breweries Stock Performance

The stock gave close to 80 times return in above long term chart. majority of price performance came in last five years. From year 2014 till date it has jumped around eight times. Before 2014 for almost seven years it have no return. The stock was in consolidation mode and prices were ranged bound from 30 to 50 INR.

Currently the stock has corrected in recent market sell off. It is also consistent dividend payer and current dividend yield is more than .5% at current market price.

GM Breweries My Opinion

GM Breweries is a Distillery Company. The Company has some old and successful brand in its kitty. Instead of flooding market with too many brands it has four prominent brands. But main revenue source is top 2 brands as mentioned above in description section.

It should look to increase number of products in market may be two three more items to decrease dependency on single brand for revenue. Region wise it is pretty much market leader in Maharastra State. Maharastra is major focus area for the Company as well.

Maharastra is one of the richest state with good population. This will help Company generate consistent revenue. But for further growth it should explore and gain market share in new regions. The experience in Maharastra should help the Company.

The Distillery sector will be on demand in future as well. As always there will be different consumer groups in this sector as well. The sector is evergreen sector with consistent demand.

I have not yet invested in this sector but may choose to invest in it. The reason for not investing is purely ethical as I do not use these products or promote them. In case you are interested in it you can compare other stocks in this sector and make your decision.

In case you are interested then you can track the company by adding it to your stock watch list. That way you can keep close eye on the Company.