Deepak Spinners Ltd. Detail

English Video

Hindi Video

Deepak Spinners Ltd is in portfolio of Subramanian P. He is one of the top investors in India. It is a Textiles Company. The company is situated in Chandigarh. As per the Company website

- It manufacture yarn of counts (8 – 40) Ne in 100% Polyester, 100% Viscose, 100% Acrylic and Polyester Acrylic & Polyester Viscose blends.

- It specializes in manufacture of dyed synthetic yarn

- It exports to countries such as Syria, the Middle East, Turkey, Belgium, and the U.S.A. to name a few.

- So the company caters domestic market along with international presence.

Now lets look at performance of this company over the years.As per Dow theory of technical analysis price performance over a period of time reflects Company state.

Deepak Spinners Ltd. Stock Performance

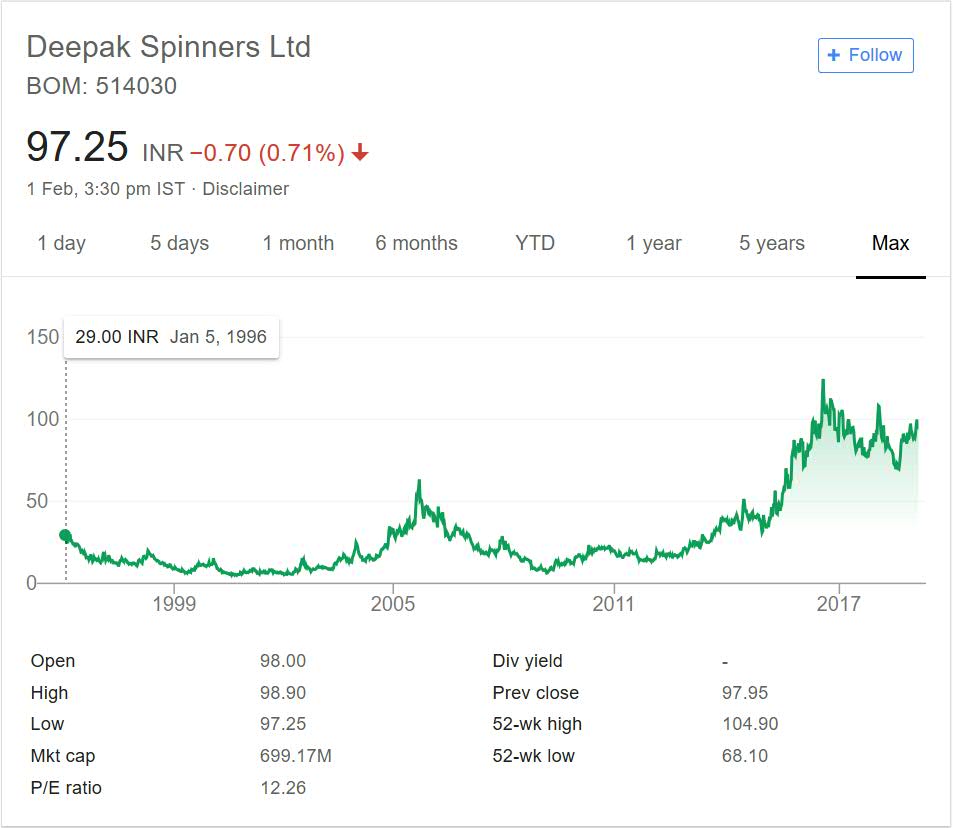

Above price chart if from year 1996 till date. It shows price performance for more than 2 decades. The company was trading at 29 INR mark two decades earlier. Move forward 2 decades later Company is trading close to 100 mark.

If you closely see the performance chart it jumped past 50 mark around year 2005. From year 1996 to 2005 it was in negative consolidation mode moving slowly downwards. The same story was repeated again.

The company moved slowly downwards again from 205 rise till year 2014. After that it jumped to 100 mark. So if you see closely it takes years of consolidation and then moved up. In this 20 year period stock has closely given 4 times return to investors.

The performance is similar to any fixed instrument investment if your entry and exit points are 1996 starting point and today’s date.

Deepak Spinners Ltd. My Opinion

Deepak Spinners Limited is in Textiles sector. I am not found of this sector as mentioned during analysis of other Textiles stocks. it is over crowded sector with many companies being listed owning single factory.

These companies have specialized products and their future growth depends on acceptance and popularity of products. The factory should also be running smoothly. In case of any issues with factory stock will plumb down heavily.

The price performance presents a sorry state for it. It has not destructed wealth of investors but has not given them returns that would compel them to invest in it. Long term performance is not good. It shows that company has not grown over the years but remained stagnant for long in same position.

Personally I avoid Textiles sector and am not interested in it. I do track Textiles machinery sector companies due to lack of companies in that sector and growth opportunities. In case you are interested then you can track the company by adding it to your stock watch list. That way you can keep close eye on the Company.