Dhanvarsha Finvest Ltd. Detail

English Video

Hindi Video

Dhanvarsha Finvest Ltd. is in portfolio of Subramanian P. He is one of the top investors in India. It is a Financial sector Company. It is a Reserve Bank of India registered Non Deposit accepting Non Banking Finance Company .

DFLTD (short form of Dhanvarsha Finvest LImited) is a retail focused NBFC that aims to support small businesses and LMI customers by offering them innovative financing solutions. DFLTD is promoted by the Mumbai headquartered Wilson Group.

It offers below Loan as per the Company website

- Working Capital Loan

- Loan Against property

- Debt consolidation Loan

- Commercial purchase loan

- Personal loan

Now lets look at performance of this company over the years.As per Dow theory of technical analysis price performance over a period of time reflects Company state.

Dhanvarsha Finvest Ltd. Stock Performance

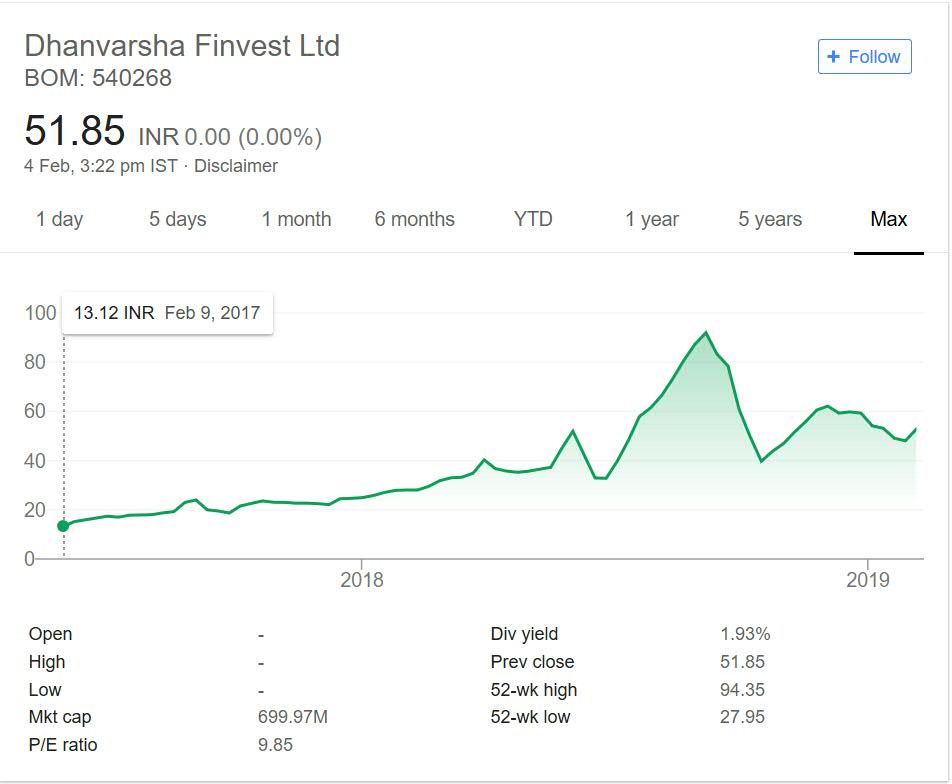

The company got listed on exchanges recently. Price chart for only 2 year is available.It debuted on exchanges at 13 INR mark. If you see the Company slowly rose to more than 80 mark giving investors handsome return of more than 6 times in short span of time.

The company is now trading at 50 odd levels which is also around 4 times return. The dividend yield at current market price is around 2% which is good by any standard. I do like companies giving good consistent dividend. It gives passive income to investors so even if prices do not increase investors will make money.

Note later part of 2018 was bearish for market so Company has seen both bullish and bearish time in last 2 years. As mentioned in previous articles and Technical Analysis articles long term chart is correct representation of any Company performance.

Dhanvarsha Finvest Ltd. My Opinion

hanvarsha Finvest Limited is in Financial sector. It is a Non banking financial company (NBFC). NBFC has been hot cake few months ago and gave handsome return to investors.

The last few months were not good because of cash crunch in NBFC. Many top housing finance companies and NBFC were hit hard. I am surprised to see even in that time frame company was not hit hard and has stood strong.

NBFC space is too saturated and there are many small and big players in this niche. Yet many of them gave stellar returns in past as India has huge potential in this space. The sector is one of the fastest growing sectors and companies can make it big if played correctly.

I am bullish on this story but stock selection if the key. Based on the past returns of 2 years Company looks decent but it is too early to say. It operates in Mumbai area so that will give some advantage to it.

I would not track it but small NBFC companies have their own set of problems. The story looks good and then comes cash issue and bad loan issues. Due to these problems I generally avoid small NBFC companies despite them giving good returns in short time frame. In case you are interested then you can track the company by adding it to your stock watch list. That way you can keep close eye on the Company.