Krypton Industries Ltd. Detail

English Video

Hindi Video

Krypton Industries Limited is in portfolio of Subramanian P. He is one of the top investors in India. The company belongs to Tyre sector. It is primarily in Bycycle tyre and should not be confused with other Tyres sector companies.

As per the Company website it manufactures and supplies of polyurethane tyres and assembled wheels for use in bicycles, Wheelchairs, Walking Sticks & other Rehab Care Products and for footwear as on today.

Krypton Tyres are sold in Australia, Africa, Far East Asia, Europe, North America and India. Below are the product categories of the Company

- Polyurethane PU Tyres – Used in Bicycle industry, Industrial Segment and Rehab Care.

- Softflex Sandals– Mainly present in Eastern India. Company plans to expand the reach.

- Wheel Chair and Equipment – The wheelchair and related tyres.

All the factories are based in Falta Special Economic Zone situated in West Bengal.The head office is present in Kolkata. It also has sales office in Europe (Czech Republic).

Now lets look at performance of this company over the years.As per Dow theory of technical analysis price performance over a period of time reflects Company state.

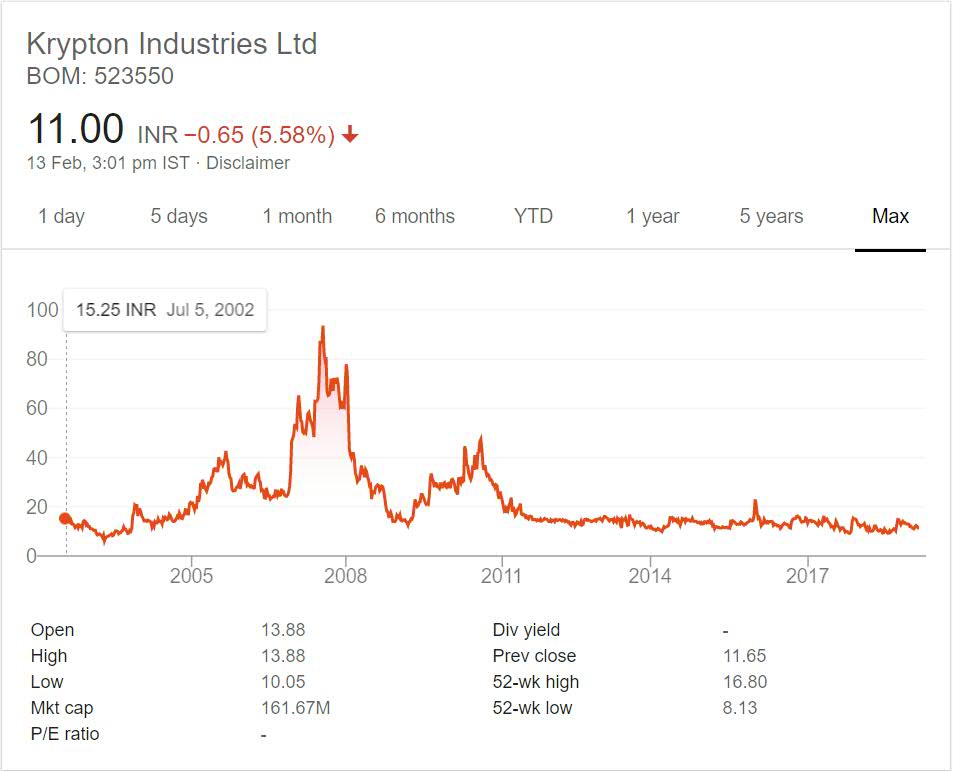

Krypton Industries Ltd. Stock Performance

The long term chart tells you the story. Once a multi bagger promising stock has become non performer with time. Before 2008 it gave close to 6 times return in 6 years. It is incredible by any means. But since year 2008 prices declined.

But real problem started after year 2010. It kept on declining year after year. There is barely any positive movement in prices. It means stock is struggling to keep up the performance in line with previous results. The performance is getting worse with time.

Krypton Industries Ltd. My Opinion

Krypton Industries looked impressive to me with business vertical. There are many companies listed in Tyre segment. But those are for Two wheeler (bikes and scooters etc) and Four wheeler vehicles.

This company is for only Bicycles. It has expanded its reach into other verticals. But those have not paid any dividends yet. As per Company website it planned to launch the Softplex brand Pan India but that has not materialized in reality.

It does have presence in Overseas market which is good. I am really interested to see how Company moves from here. Bicycles will make a come back and become popular in urban mass as well due to environment and health reasons. It will soon become Luxury than necessity.

I will keep it in my radar but as of now based on past performance it is not good bet for investing. Note Bicycle tyre sector is largely unorganized. Also there is no brand requirement from Customers due to price involved.

In case you are interested then you can track the company by adding it to your stock watch list. That way you can keep close eye on the Company.