Lahoti Overseas Ltd. Detail

English Video

Hindi Video

Lahoti Overseas Limited is in portfolio of Subramanian P. He is one of the top investors in India. The company belongs to Textiles sector.

As per the Company website it offers Cotton Yarns including carded, combed & compact ring spun yarns of coarse & fine counts, ply yarns and special yarns. It has now expanded to other fibers and offering yarns like Viscose Spun, Polyester Spun, Polyester DTY, Linen, PVA, Blended Yarns and Slubs

It has more than 100,000 spindles running for them on commission spinning and it controls the production & quality completely. The product lines of the Company are mentioned below

- Yarns – Variety of cotton yarns, flex yarns, melange yarns and synthetic yarns .

- Fabrics– Different kinds of knitted, woven as well as denim fabric .

- Organic BCI Products – Diversified range of raw cotton like S-6, Mech, Bunny, J-34 etc.

- Raw Cottons – Organic cotton yarn

The company makes use of Renewable energy. It produces Solar Energy in Rajasthan plant (2MW). The plants in Rajasthan, Madhya Pradesh, Maharastra and Tamilnadu uses Wind Power (using Wind Mill) generating 6MW power. This helps in minimizing cost to run the factory.

It exports products in African countries, Europe and Middle East Asia along with catering domestic needs. It has offices outside India to look after overseas sales.

Now lets look at performance of this company over the years.As per Dow theory of technical analysis price performance over a period of time reflects Company state.

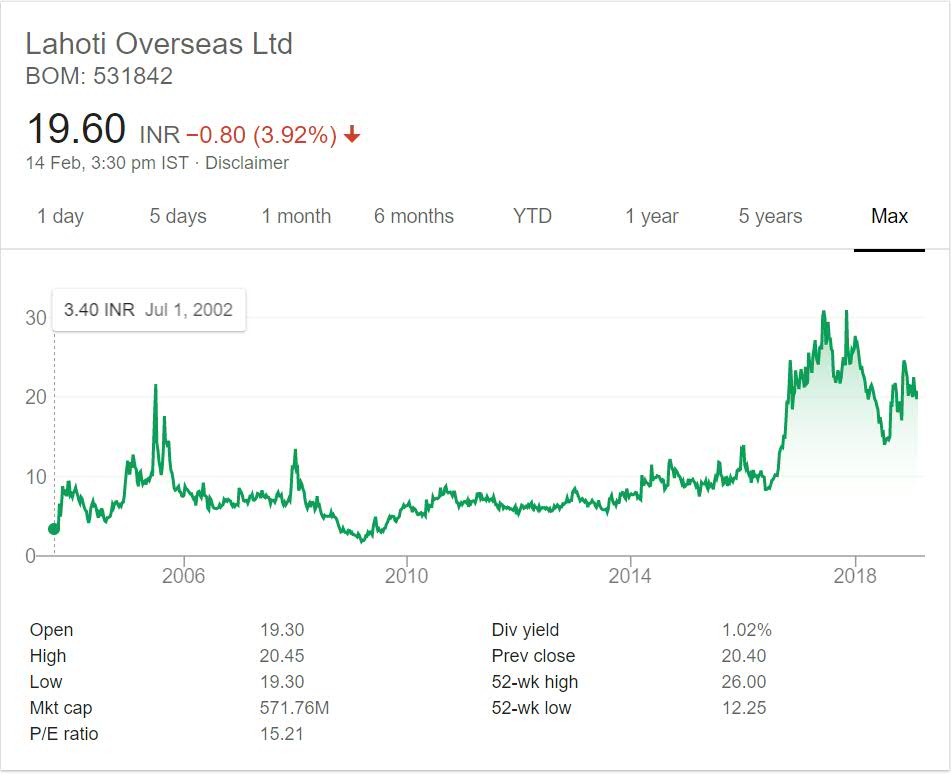

Lahoti Overseas Ltd. Stock Performance

The lowest price point in above chart is approx 2 INR price after 2008 global crisis. From there the stock kept hovering round 10 INR mark for quite sometime. In fact for next 5 years it traded around 10 mark slowly rising above it till year 2016.

It is towards the later point it moved past 20 and touched the 30 mark. The stock does pay 1% dividend at current market price. It can be viewed as decent stock with fair enough returns in these years.At least it has not caused loss to investors.

Lahoti Overseas Ltd. My Opinion

Lahoti Overseas Limited is yet another Textiles stock. I personally does not like this sector. You may know this as I have mentioned it clearly in past. Most of the textiles companies have given meager returns or no returns in past decade. They have their own shares of problems.

If you observe long term price chart then Company has not performed bad. It has given healthy return to investors and clearly beaten Fixed deposits. So performance wise this is decent stock.

The overseas presence will help in export and thus increase the revenue. Company has shown some vision with Renewal energy initiatives to meet internal power demand thus lowering the run cost of factories.

As I do not track or invest in Textiles stock I will leave this counter as well. In case you are interested then you can track the company by adding it to your stock watch list. That way you can keep close eye on the Company.