RDB Rasayans Ltd Detail

RDB Rasayans Limited is in portfolio of Subramanian P. He is one of the top investors in India. The company belongs to Packaging sector.

As per the Company website it is in business of FIBC manufacturing. It has capabilities to roll out 1.5 million bags of PP Woven Sacks and 60,000 Jumbo Bags (FIBC) in a month, the products ranges from high- resistant jumbo bags (FIBC) spanning the 500 Kg – 2000Kg category in the Baffle, Circular and C Panel bag design segment.

The product segment of Company can be divided into two parts

- Bulk Bags FIBC

- Multiwall Bags

The Bulk bags segment is further sub divided into Standard bags, Baffle bags, Corner Loop bags, Full loop bags, Circular bags, Sling loop bags, UN bags, Conductive bags and Electrostatic bags.

Multiwall bags are divided into PP valve bags, PE valve bags and Lami bags.

The Company has registered office in Kolkata.The factory is located in Haldia West Bengal. Haldia ports helps the Company in easy transportation of its products.

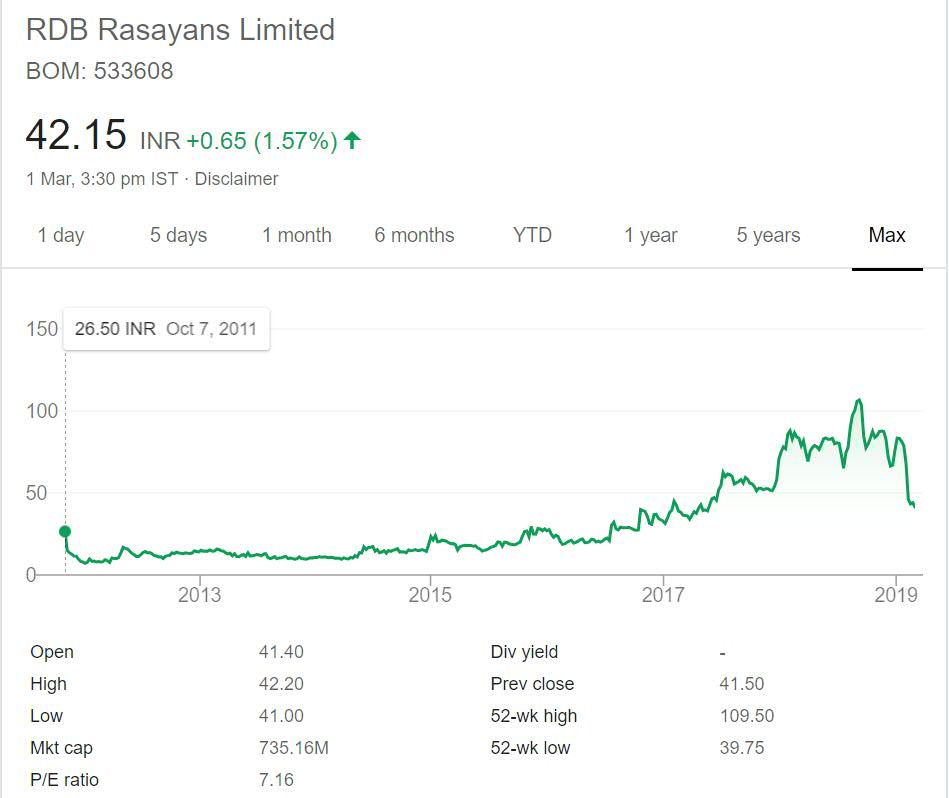

I have shared long term price performance chart of the Company below.As per Dow theory of technical analysis price performance over a period of time reflects Company state.

RDB Rasayans Ltd Stock Performance

RDB Rasayans go listed in year 2011 at listing price of 26 INR. It continued to trade near 15 mark for next 4 years or so. This can be taken as consolidation time after initial IPO. Most companies have slow price movement after IPO (Sometimes due to high IPO pricing and bad listing).

After year 2015 it steadily rose and traded above 100 mark for brief period. The company since then has moved past below 50 mark due to recent correction in market (towards end of 2018 and start of 2019). In last 7 years it has given 2 times return to investors.

RDB Rasayans Ltd My Opinion

RDB Rasayans is in packaging sector. The company mainly deals with Packaging stuff though the website mentions other business like Real Estate, Printing, Ware housing and Cigarettes.

I will not discuss other business listed on website. These are more of historic exploits of the Company. Right now it focuses mainly on FIBC and other products mentioned in details section.

Packaging has some good and big companies listed.Personally I am not very interested in this sector. This sector serves other industries. Every industry has different and more than one packaging requirement. The growth of packaging sector depends on demand in packaging item it provides. Right now growth in consumer product based packaging is more than industrial packaging items.

I will not be tracking or investing this Company. There is no uniqueness in the Company and I do not think the sector will grow at fast rate. So I will not be putting my money on this Company or sector as a whole.

In case you are interested then you can track the company by adding it to your stock watch list. That way you can keep close eye on the Company.