Remi Edelstahl Tubulars Ltd Detail

Remi Edelstahl tubulars Limited is in portfolio of Subramanian P. He is one of the top investors in India. The company belongs to Tubes and Pipes (Steel) sector.

As per the Company website it started stainless steel manufacturing process in year 1970 in association with Kobe Steel Japan. As of now it has production capability of 12,000 MT per annum. The manufacturing plant of Company is located in Tarapur.

The product segment of Company can be divided into below parts

- Welded Tubes

- Welded Pipes

- Seamless pipes

- Cold drawn Seamless tubes

These products are used in different industries like Refineries, Petrochemicals, Fertilizers, Pharmaceuticals, Paper & Pulp Industries etc. The Company is approved by all chief consultants in India and abroad, such as TUV, Bureau Veritas, TOYO, UHDE, FWL, Bechtel, Technip etc.

Some projects company have completed in past are of marquee clients like Reliance Refineries, HPCL and Larsen and Toubro.

The Company has registered office in Kolkata.The factory is located in Haldia West Bengal. Haldia ports helps the Company in easy transportation of its products.

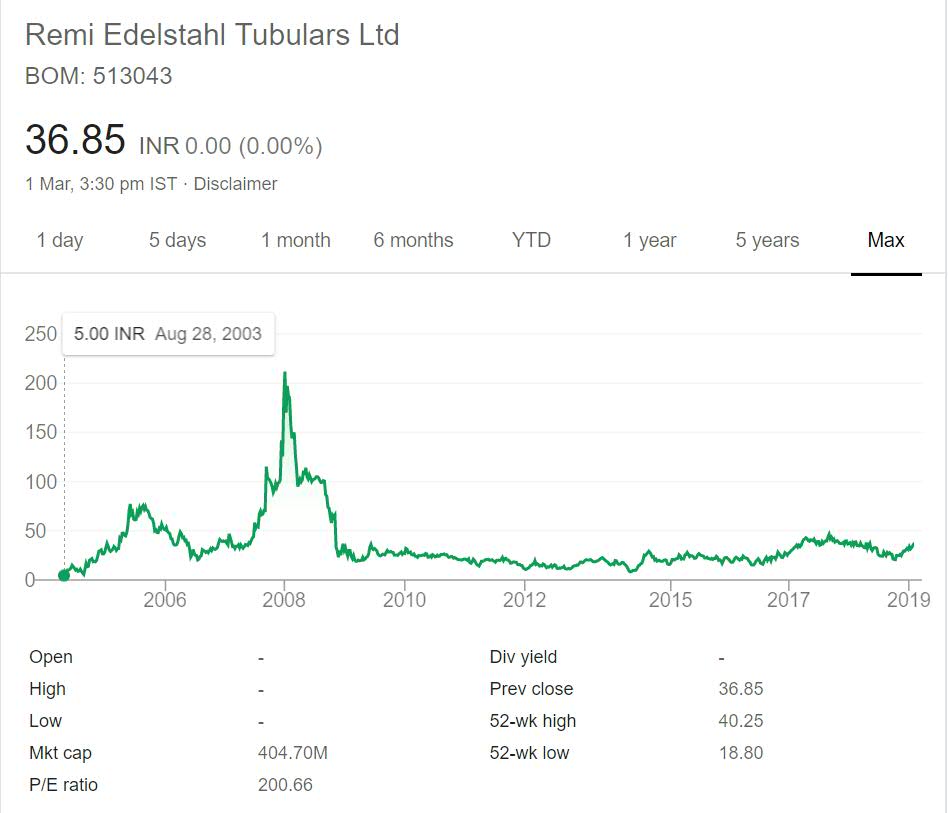

I have shared long term price performance chart of the Company below.As per Dow theory of technical analysis price performance over a period of time reflects Company state.

Remi Edelstahl Tubulars Ltd Stock Performance

The stock has traded below 50 mark most of the time in last 16 years. It only crossed this and zoomed past 200 in year 2008. But after the Global crisis it never crossed 40 mark decisively.

After year 2009 it never gave positive returns. Most of the time the stock remained stagnant and move downwards. It tested patience of investors. If you see from year 2010 till date the stock price line is almost horizontal with slow up and downs sometimes.

Remi Edelstahl Tubulars Ltd My Opinion

Remi Edelstahl tubulars limited is in Steel Pipes and Tubes sector. The products are meant for different industries. So it can be categorized as Business to Business entity.

The Company has completed some good projects for large customers. It will help the Company get future orders by showcasing the large projects it has performed for Clients like Reliance and HPCL etc.

The raw materials play an important role in profit of this Company. Steel is used as a raw material in the Company. It imports the raw materials from countries like China, Singapore and also consumes from local players in India like SAIL and Jindal Steel.

In past decade most Steel Companies and Steel based Companies have struggled to give decent returns. The sector is mainly cyclic and best way to make money is to invest at low levels and book profit at high levels. You can not sit and invest in these counters. It is important to understand the cycle in order to make money. This becomes difficult for Retail investors so I do not track this Company nor suggest others to invest in it.

In case you are interested then you can track the company by adding it to your stock watch list. That way you can keep close eye on the Company.