Overview

Yes Ban is in news for all bad reasons. It was one of the decorated banks few quarters back. But recently stock prices have plummet quite significantly. It is trading in range of 90 to 95 for last few trading session.

Yesterday it gave massive jump and while it crossed 99 mark it broke resistance with volume. I was late to open my system and missed the CALL trade for 100 CE. It was trading at 7 at that time and went towards 10 mark.

But it gave me chance to play the trade I will outline below. Not on the positive side but on the negative side.

Note I am not SEBI registered Analyst and this is not recommendation. This is my online trade log for reference and others can also use it as learning process.

Trade Details

I used couple of tools for this trading.

- Yes Bank Open Interest Excel Sheet (download link)

- Support and Resistance as shown in below image

Yes Bank crossed 99 resistance and moved towards 110 point mark. It was yet another resistance area for the stock. Both on the technical price side as shown in above graph and Open interest analysis sheet as well.

Today is result day for the Stock and there were mixed reactions about it. Last result was too bad. So there was chance for correction due to unpredictable results and stock hitting resistance area.

Profit Details

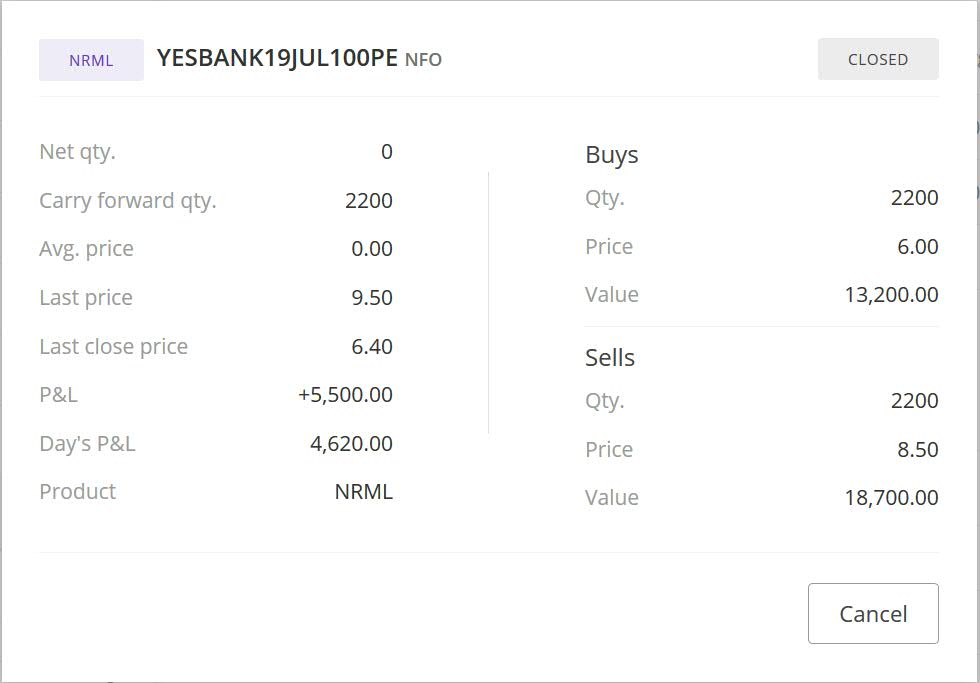

Below is profit details proof for visitors and my own record. Below is my investment and profit details

- Bought Put of 100 at 6.

- Total money is (2,200 *6) = 13,200 as lot size is 2,200 for Yes Bank

- Sold the Put of 100 at 8.5

- Total money made = (2,200*8.5) = 18,700

- Total Profit = 18,700 – 13,200 = 5,550

- Profit percent = (5,500 / 13,200 ) * 100 = 51.4%

I have decided to give details image as it will help you by providing more details and will also help me easily refer the top and bottom prices on that day.

Lesson Learnt

Below are lessons learnt from this trade which will help me in future trades

First Lesson

I bought the Option on 16th. The mistake was I bought it slightly before the resistance. The price paid was 6 for the option which was bit more than my liking. Also I was planning to buy 90 PE initially.

I should have bought 90 PE as it was cheaper and appreciated more than 100 PE.

Second Lesson

One good thing I did was not to carry the Option over night predicting result to be bad. I may have missed heavy profit if results are bad. I should have bought 90 PE later on the day after booking profit and being prepared to book in loss on 18th if market gives positive movement.

If there was negative I would earn more. So it next time I will be happy to execute a trade with Profit predicting the results in volatile counter.

Third Lesson

DHFL was very bad miss by me. I should have taken the trade before result day. It was on my radar but got busy with other stuff. Next time onward make list of stocks like these and set a reminder.