Welspun Enterprise Detail

Welspun Enterprise is in portfolio of Akash Bhansali and Dilip Kumar Lakhi. He is one of the top investors in India. The company belongs to Real Estate sector.

As per the Company website it is part of Welspun group. It is both a operating company as well as holding company. It deals with Infrastructure projects related to Road and Water.

It works on Water supply projects, Highway projects and Toll projects.Below are the list of Companies which are part of Welspun Group

- Welspun Group

- Welspun Corporation limited

- Welspun India limited

- Welspun Steel limited

- Welspun USA Inc

- Welspun UK limited

- Welspun Middle East pipe

- Welspun invetments and Commercials

- RMG Alloy Steel

- Welspun Natural resources private limited

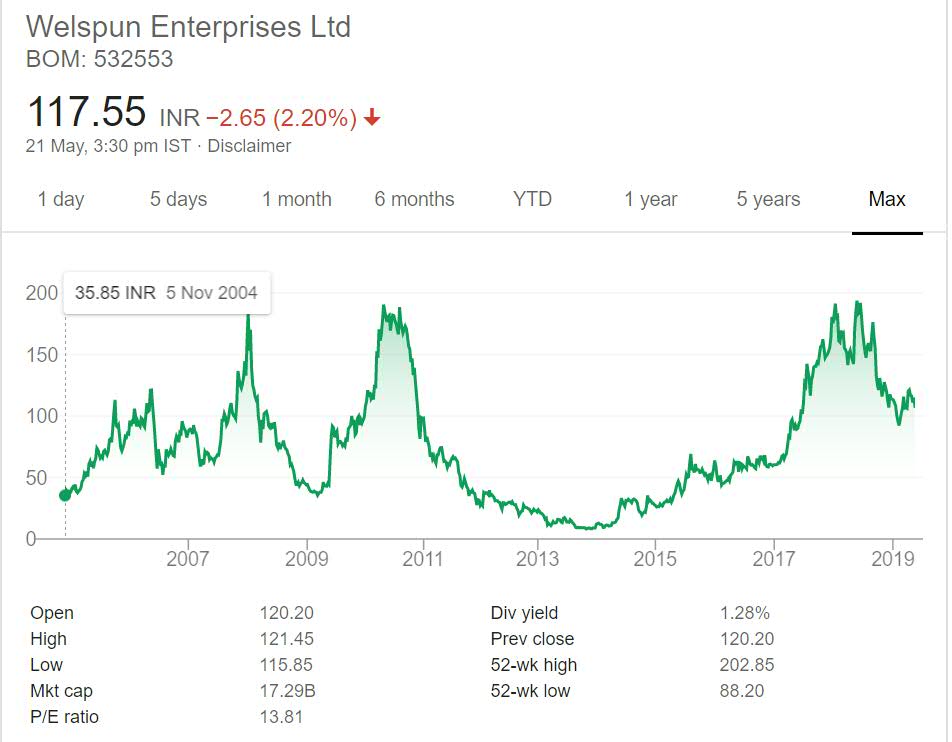

I have shared long term price performance chart of the Company below.As per Dow theory of technical analysis price performance over a period of time reflects Company state.

English Video

Hindi Video

Welspun Enterprise Stock Performance

This stock has fluctuating past.Looking at the long term price performance it is not advised to invest in the stock for long term. You can trade this stock based on the support and resistance concept or any news or as per your stock analysis. But this one is not long term invest and forget type of stock.

It has witnessed very steep correction and long consolidation period from 2011 to 2016. Any stock with this long period of consolidation and correction will test patience of investors and they will be tempted to liquidate their holdings. However people investing at those levels have made good money in the counter.

At current market price the dividend yield of the Company is more than 1% which is decent by any standard.

Welspun Enterprise My Opinion

Welspun Enterprise is a Holding Company Company. It has real estate operations as well. Holding Companies are parent Companies which hold share in other companies of the Group.

The performance of holding companies is linked to performance of underlying group companies it is holding and any business of its own. So if you are interested to buy holding Company then you should also look at companies in which it has stakes and how well the child companies are performing.

If the Child companies perform better with time then the holding Companies will perform better. Note holding companies often pay good dividend. So if you are looking for consistently good dividend paying company then you should look after holding companies as well.

As of now I have not invested in any holding company. But I am exploring this vertical and may add one of the holding companies to my portfolio. I have not yet finalized which company to invest in as analysis is in progress.

In case you are interested then you can track the company by adding it to your stock watch list. That way you can keep close eye on the Company.